Cross-Border E-commerce 'Invoice-Free Tax Exemption' Goes Live! Shenzhen Officially Launches Operation on February 1

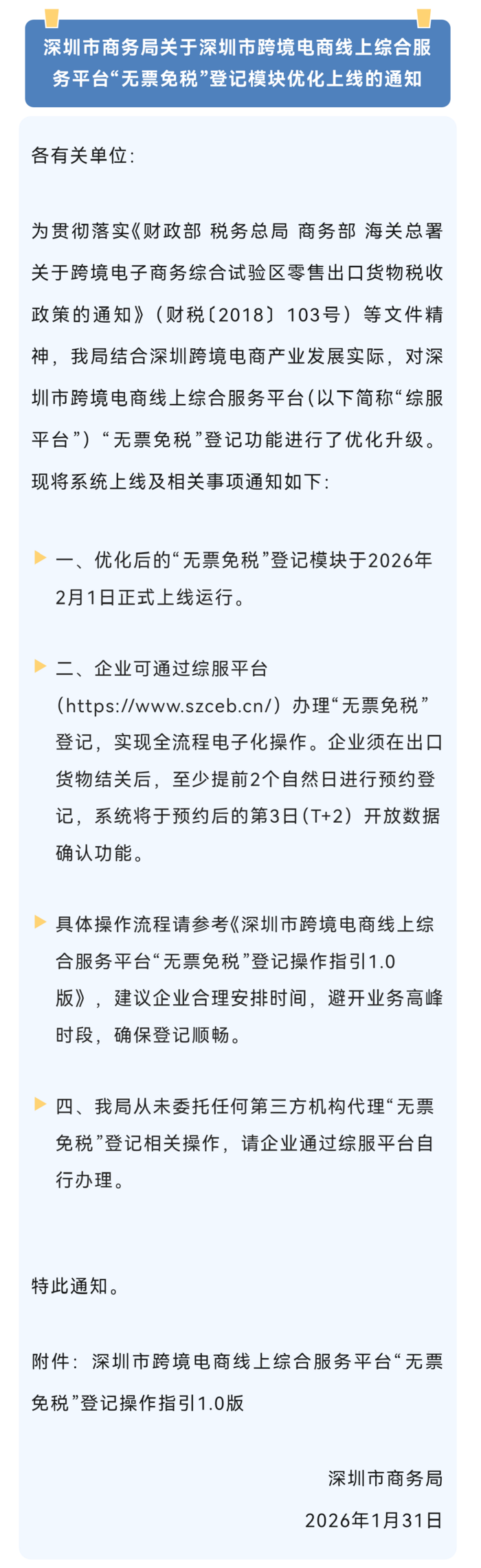

[Ebrun Exclusive] Recently, the Shenzhen Municipal Commerce Bureau issued a notice announcing that the "Invoice-Free Tax Exemption" registration function on Shenzhen's Cross-Border E-commerce Online Comprehensive Service Platform has been optimized and upgraded, and will be officially launched and operational on February 1, 2026.

Enterprises can handle "Invoice-Free Tax Exemption" registration through the comprehensive service platform (https://www.szceb.cn/), achieving a fully electronic process. However, it is important to note that enterprises must schedule their registration at least 2 calendar days *after* the export goods are customs-cleared. The system will open the data confirmation function on the 2nd day (T+2) after the scheduled appointment.

It is reported that the "Invoice-Free Tax Exemption Registration" system applies to cross-border e-commerce retail export enterprises, specifically the domestic consignors or production/sales units declared on the 9610 export list/customs declaration form, as well as the actual seller noted in the customs declaration header or list item remarks (using the Unified Social Credit Code), for export tax exemption registration. It only supports Shenzhen-based enterprises that declare through the Shenzhen Cross-Border E-commerce Online Comprehensive Service Platform with cleared lists, or declare through the Shenzhen Single Window with cleared customs declarations. For exports handled via an "agency" model, the customs declaration agent (i.e., the domestic consignor) must also be a Shenzhen enterprise.

Industry insiders pointed out that the optimization and upgrade of the "Invoice-Free Tax Exemption" registration function is a very significant step forward, creating a "smooth and open path" for cross-border e-commerce retail export enterprises.

Firstly, it addresses the pain point for many small and medium-sized sellers who cannot obtain invoices from small-scale factory purchases – as long as the goods are genuinely exported, even without upstream input invoices, there is now a compliant pathway to enjoy exemption from Value-Added Tax (VAT) and Consumption Tax. Secondly, it guides businesses engaged in genuine transactions to use their own entities for compliant declaration and tax exemption benefits, shifting them away from grey-area practices (such as "buying export rights") towards transparent and compliant declaration. Furthermore, the new system supports online batch selection and one-click registration confirmation based on the enterprise's 9610 customs declaration forms or lists, with a fully electronic registration process, which is expected to significantly improve approval efficiency.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com