Youkeshu Renamed 'Xingyun Technology': Boardroom Power Struggle Ends as Wang Wei Takes Full Control of Corporate Restructuring

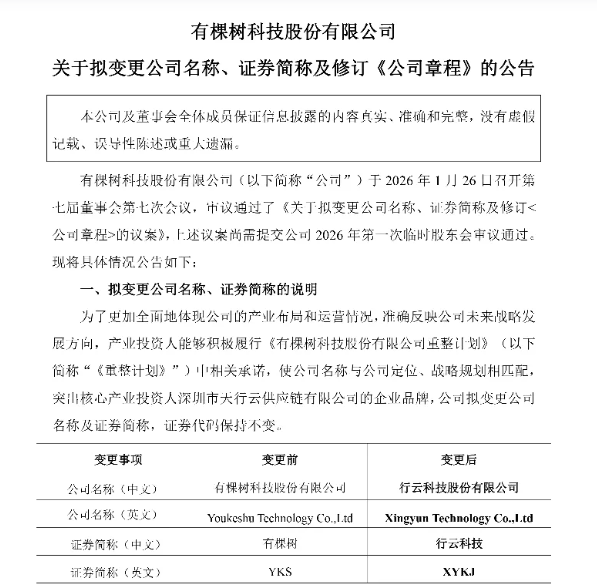

[Ebrun Original] On January 29, veteran cross-border seller Youkeshu announced that, to align with its strategic transformation and the brand positioning of its industrial investor, the company's full name will change from "Youkeshu Technology Co., Ltd." to "Xingyun Technology Co., Ltd." effective February 11. The stock abbreviation will correspondingly change from "Youkeshu" to "Xingyun Technology," while the stock code "300209" remains unchanged.

Following the news, Youkeshu's stock price rose. At the close on the announcement date, Youkeshu was trading at 7.26 yuan per share, with a total market capitalization of approximately 6.742 billion yuan. The stock has accumulated nearly a 60% increase over the past year, and its trailing twelve-month (TTM) P/E ratio reached 91.76.

This renaming coincides with the 100-day mark since the new management team nominated by Shenzhen Tianxingyun Supply Chain Co., Ltd. (referred to as "Xingyun Group"), where Wang Wei is the actual controller, fully took over company operations. This is widely seen as a significant indicator of the substantive shift in company control and strategic direction.

Xingyun Group, which led the corporate restructuring and renaming, was founded in 2015. As a leading global commodity B2B service platform in China, it is dedicated to providing global channel operations, distribution, and cross-border trade services. It has built a comprehensive global commodity service system integrating overseas expansion services, brand services, channel services, cross-border logistics services, and more.

The group has been repeatedly listed among the "Top 500 Chinese Private Enterprises" and the "Top 100 Chinese Private Enterprises in the Service Industry." It currently employs over 3,000 people globally and provides digital supply chain services covering nearly 150,000 SKUs to nearly 500,000 small and medium-sized retailers and over 3,000 domestic and international consumer brands. It holds more than 170 warehouses worldwide, with a total storage area of 1.3 million square meters.

Reviewing Xingyun Group's capital layout, as early as September 2024, its substantial controlling company, XINGYUN INTERNATIONAL COMPANY LIMITED, signed a merger agreement with SPAC company Chenghe Acquisition II Co. (CHEB), planning a backdoor listing on the American AMEX.

Earlier, market rumors suggested it was planning a pre-IPO financing round in Hong Kong and advancing towards an IPO, with a fundraising target of approximately $200 million and a target valuation of around $2.5 billion, but this information was not officially confirmed.

Against this backdrop, the "renaming event" and the business restructuring it symbolizes represent not only a clear assertion of control over the listed platform and a repositioning of the "shell resource," helping to dilute Youkeshu's historical baggage and rebuild investor recognition and trust, but also perhaps a hedging strategy for Xingyun Group's domestic and international financing paths.

While its move towards a US listing attracts significant attention, the stable existence of an A-share listed platform provides more flexible options for advancing financing, mergers and acquisitions, and listings under different market conditions.

However, contrasting with the resolved control issues, the company's fundamentals remain under considerable pressure. Disclosed alongside the announcement was Youkeshu's belated Q3 2025 financial report – all performance metrics were poor.

Data shows that in the first three quarters, the company achieved operating revenue of 58.9567 million yuan, a sharp year-on-year decrease of 82.02%. Net profit attributable to shareholders of the listed company was -13.8528 million yuan, compared to a loss of 30.5657 million yuan in the same period last year.

Looking solely at the third quarter, the company's operating revenue was 16.3833 million yuan, down 83.59% year-on-year; the net profit attributable to the parent company's shareholders was a loss of 15.7298 million yuan, a staggering year-on-year decline of 5,169.86%.

Over a longer period, the company had just returned to profitability in 2024. In the first half of last year, total operating revenue plummeted 81.33% year-on-year, with net profit attributable to the parent company's shareholders at 1.877 million yuan, maintaining only a slight profit. The significant return to loss in the third quarter may negatively impact full-year performance.

At the corporate governance level, the company disclosed the progress of the new management team's integration of historical issues.

As of December 31, 2025, the company had gained control over the seals, business licenses, and other core assets of 26 subsidiaries, and completed the handover of the parent company's seals, business license, and information disclosure U-shield. In November 2025, the company signed a four-party supervision agreement and contributed 100 million yuan in capital to a subsidiary to support business expansion.

Meanwhile, some subsidiaries have not yet completed the business handover, involving total assets of 64.7076 million yuan, net assets of -10.5955 million yuan, and operating revenue of 601,200 yuan, accounting for 5.52%, -1.11%, and 1.17% of the corresponding consolidated financial statement indicators for the first three quarters of 2025, respectively. Additionally, some subsidiaries are involved in an arbitration case concerning nearly 100 million yuan in unpaid logistics service fees.

Looking back at the company's history, Youkeshu was founded in 2010 by Xiao Siqing. Initially, it rapidly expanded by leveraging a multi-category strategy including electronic products, outdoor equipment, and home goods, supported by Shenzhen's supply chain advantages, benefiting from the early boom in the cross-border e-commerce sector. It achieved a backdoor listing in 2017.

However, its growth was primarily driven by an extensive model relying on "multiple platforms, multiple accounts, and multi-category bulk listing." As competition in the cross-border e-commerce market intensified, platform rules tightened, and supply chain and traffic costs rose, its profit margins were continuously squeezed, leading to sluggish business growth.

Blind expansion also led to worsening inventory backlog and increasing compliance pressures, ultimately resulting in an unbalanced profit structure, highly strained cash flow, and continuous performance decline: from 2020 to 2023, the company accumulated losses exceeding 4 billion yuan.

In April 2024, the Shenzhen Stock Exchange issued a delisting risk warning to Youkeshu. Later that year, due to its inability to repay due debts and severe insolvency, the court accepted the application for restructuring.

According to the restructuring plan, Tianxingyun entered as the lead industrial investor, leading to fundamental changes in the company's shareholding structure and actual control.

In March 2025, Youkeshu disclosed a detailed report on changes in equity, showing that Wang Wei and his concert parties collectively held 18% of the company's shares, while Xiao Siqing's stake was passively diluted to 3.28%.

After the restructuring was completed, disagreements over company control and governance gradually became public.

In May 2025, Wang Wei and others proposed convening an extraordinary general meeting for an early board election, but the proposal was unanimously rejected by the incumbent board. It wasn't until October 2025 that an EGM convened by Wang Wei and Liu Zhihui was finally held. The company completed the election of the seventh board of directors, with all seven directors nominated by Wang Wei elected. The former core management team under Xiao Siqing all stepped down, and the new team announced a full takeover of company assets, operations, and finances.

The prolonged internal governance conflict directly disrupted daily operations and caused the delayed disclosure of the Q3 2025 financial report.

With the renaming complete and the new board fully in charge, Xingyun Group's integration of the listed company has entered a substantive phase. However, whether it can drive Xingyun Technology towards business recovery and strategic transformation, given the complex historical baggage and pressured performance, remains to be tested by time and future results.

Ebrun will continue to track this development. To learn more related information, please scan the QR code to follow the author's WeChat.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com