Meta Q4 Earnings: Ad Revenue Up 24% YoY, AI Glasses Sales Triple in a Year

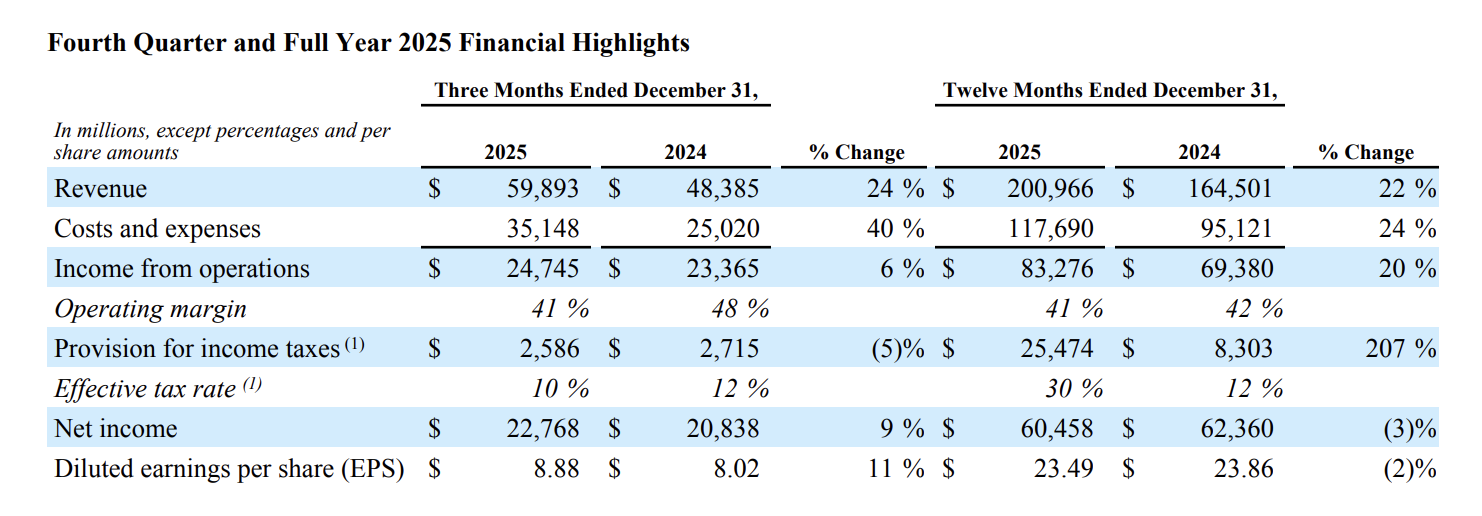

[Ebrun Original] January 29 - Meta released its financial results for the fourth quarter of fiscal year 2025. The report shows that Meta's Q4 revenue reached $59.893 billion, a 24% year-over-year increase, surpassing market expectations of $58.45 billion. Net profit was $22.768 billion, up 9% year-over-year.

In terms of overall structure, Meta's revenue sources remain highly concentrated in advertising. In Q4, Meta's advertising revenue reached $58.137 billion, a 24% increase compared to the same period last year. Meanwhile, the average daily active users (DAU) for the Meta app family (including Facebook, Instagram, WhatsApp, and Messenger) reached 3.58 billion, a 7% year-over-year increase.

Market analysis suggests that in Q4 2025, constrained by an unstable trade environment, major advertisers were adjusting their budgets towards more cost-effective performance advertising, which partially contributed to Meta's performance growth.

From a product perspective, multiple rounds of adjustments to Meta's content distribution mechanism in Q4 directly supported the advertising business. Watch time for Instagram Reels in the US grew 30% year-over-year, while Facebook video watch time maintained double-digit growth. By simplifying the ranking architecture and supporting longer interaction histories, overall views for Facebook's organic News Feed and video posts increased by 7% in Q4. Management noted on the earnings call that this was the single most impactful product optimization for revenue in a quarter over the past two years.

Additionally, in Q4, approximately 75% of recommended content on Instagram in the US came from original creators; the number of Reels pushed daily on Facebook increased by over 25% quarter-over-quarter. After algorithmic optimization, user time spent on Threads increased by about 20%, gradually forming a more sustainable usage structure.

Driven by the combined effect of these factors, Meta's ad impressions grew a further 18% in Q4.

On the earnings call, Meta management repeatedly emphasized that large language models are being continuously integrated into the company's existing product ecosystem and advertising recommendation system. Mark Zuckerberg stated that Meta is deeply integrating AI capabilities with Facebook, Instagram, Threads, and the advertising system. Although the current recommendation system has significantly boosted content distribution and advertising efficiency, he believes this is still "a very early stage."

According to Meta's vision, the recommendation system will evolve beyond just understanding user interests to gradually comprehend each individual's longer-term, personalized goals, adjusting the News Feed content structure accordingly, thereby creating new impacts on both content consumption and commercial conversion. This change is also being introduced into the monetization system. Zuckerberg mentioned that Meta Ads can already help businesses accurately reach potential consumers.

He stated that advertising will remain the most important growth driver for Meta in the coming years, but Meta is also exploring new monetization paths. Currently, there are two relatively clear B2B paths:

One path is business messaging and WhatsApp monetization. Data shows that WhatsApp's paid messaging service annual revenue has surpassed $2 billion, and Click-to-message ads continue to accelerate, growing over 50% year-over-year in the US market. Meanwhile, Business AI is undergoing early testing in markets like Mexico and the Philippines, handling over 1 million conversations per week, with plans to expand to more countries and handle more business tasks that can be completed within WhatsApp.

The other path is the monetization of other product lines, such as the imminent full rollout of ads on Threads. Just this week, Threads' monetization began simultaneously, allowing advertisers to gradually serve ads to all global users through the Advantage automated system. Official data shows Threads has over 400 million monthly active users, 140 million daily active users, and a user engagement rate of 35%.

On the capital expenditure front, Meta provided guidance far exceeding market expectations. The company expects 2026 capital expenditures to reach $115 billion to $135 billion, nearly double the actual 2025 expenditure ($72.2 billion) and significantly higher than the previous market expectation of around $110 billion. Simultaneously, Meta expects full-year 2026 operating expenses to rise to $162 billion to $169 billion.

During the earnings call, Zuckerberg also repeatedly reiterated his commitment to long-term AI investment. On the hardware front, he explicitly positioned AI smart glasses as the next-generation core computing terminal, comparing the current phase to the pivotal stage when smartphones replaced feature phones. Zuckerberg revealed that sales of Meta smart glasses have tripled over the past year, calling them "one of the fastest-growing consumer electronics products in history."

Furthermore, during this call, Zuckerberg also proactively mentioned the acquisition of Manus for the first time. He noted that many businesses already pay to subscribe to Manus tools, and Meta is integrating such tools into the advertising and commerce platforms it provides, offering more integrated solutions for the millions of businesses using Meta.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com