WOOK Files for Hong Kong IPO: A 3C Wholesale Marketplace in Indonesia Serving 40,000 SMEs

[Ebrun Original] Recently, cross-border platform WOOK (Woke Feifan) submitted its preliminary prospectus to the Hong Kong Stock Exchange for a main board listing, with Huatai International as the sole sponsor.

WOOK's primary business model is S2B2C, sourcing from Chinese factories upstream and serving small and medium-sized retailers downstream through local direct sales and marketing teams.

According to Frost & Sullivan data, retail markets in Indonesia, Vietnam, the Philippines, and similar regions are expanding rapidly, yet traditional retail models still dominate. SMEs in these markets face challenges such as high procurement costs, low delivery efficiency, and limited operational capabilities. WOOK addresses these pain points by integrating resources across the entire chain from factory to retail terminal via its self-developed, end-to-end data platform, establishing a proprietary brand matrix and supply chain platform in Southeast Asia.

The prospectus shows WOOK already serves over 40,000 SMEs and has built a series of own brands in Indonesia, including VIVAN and ROBOT in the 3C category (covering power banks, charging cables, Bluetooth speakers, etc.) and SAMONO in the small household appliance category (covering food processors, ovens, air fryers, etc.).It is reported that on the supply chain side, WOOK has collaborated with hundreds of domestic brand factories for over a decade.

Currently, WOOK's core market is Indonesia, with gradual expansion into Vietnam, Thailand, the Philippines, and other regions. According to Frost & Sullivan, based on 2024 retail sales value, WOOK ranked as the number one Chinese cross-border company in Indonesia for the 3C accessories category and the sixth for the small household appliance category.

Channel-wise, WOOK operates 55 official flagship stores on major e-commerce platforms like Shopee and Tokopedia and also sells on TikTok. By September 30, 2025, WOOK's localized live-streaming operations covered four countries, building a creator network of over 100,000 KOLs.

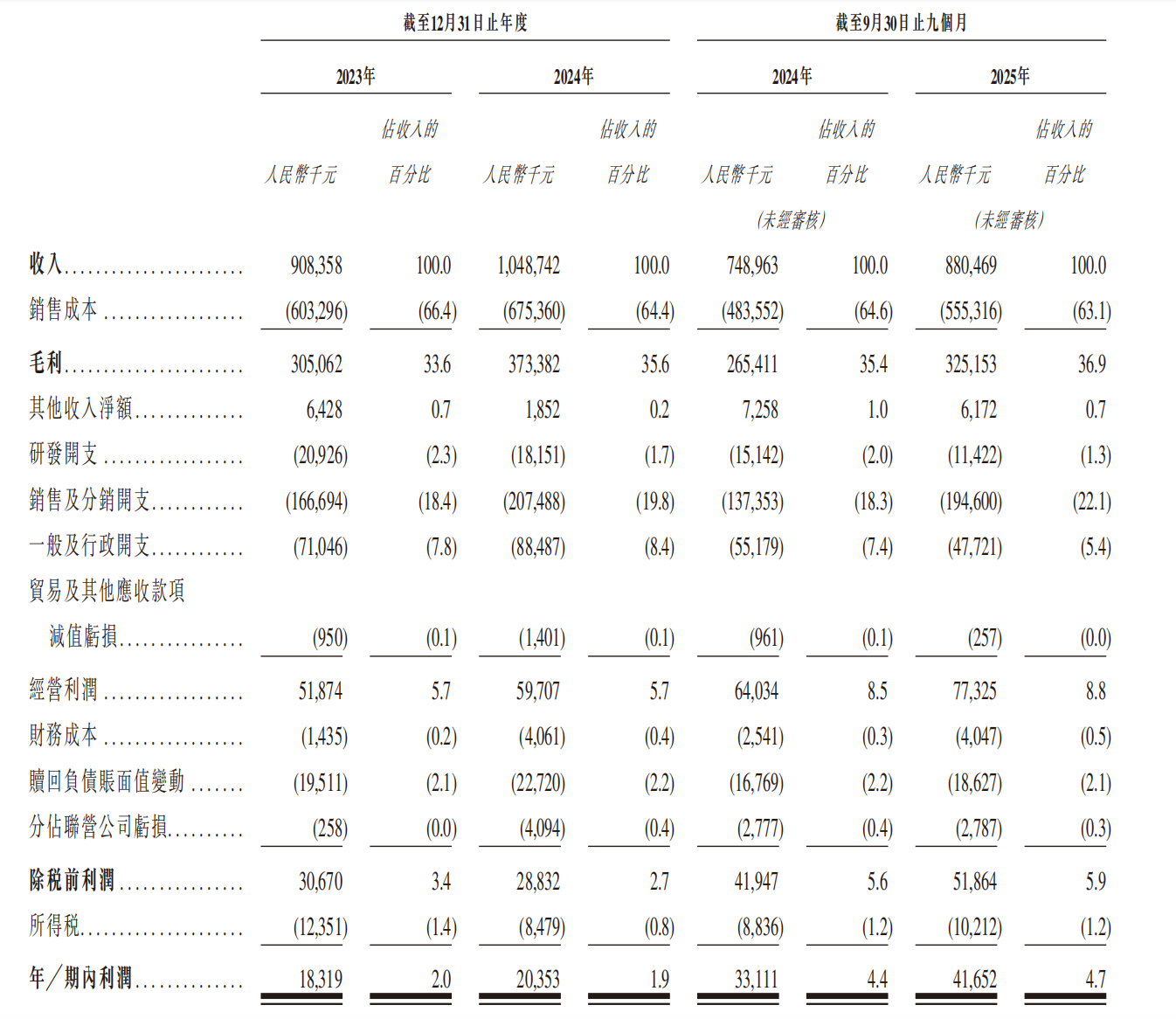

Financially, WOOK's revenue reached RMB 908 million in 2024, a 15.5% year-on-year increase. For the first three quarters of 2025, revenue was RMB 880 million, up 17.5% year-on-year.

Gross margin was 33.6% in 2023, 35.6% in 2024, and 36.9% for the first three quarters of 2025; adjusted net profit was RMB 47 million, RMB 79 million, and RMB 62 million for the same respective periods. Concurrently, WOOK continues to intensify expansion into new markets, with revenue from Vietnam, Thailand, the Philippines, and other areas growing 68.5% year-on-year in the first three quarters of 2025.

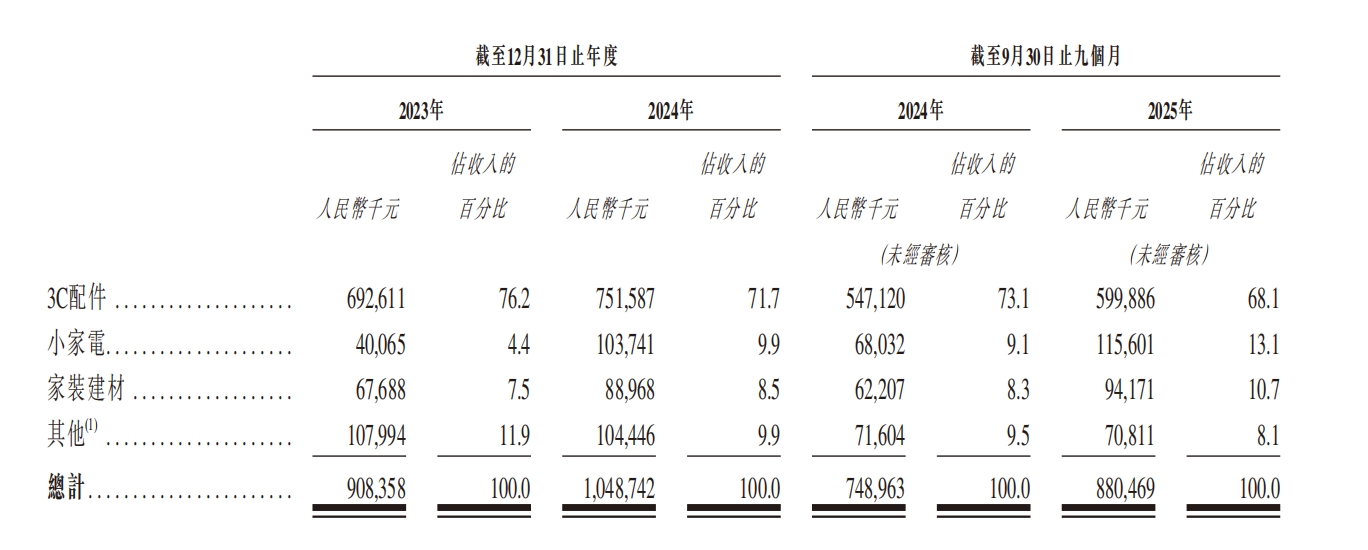

By category, revenue from 3C accessories was RMB 600 million in the first three quarters of 2025, accounting for 68.1% of total revenue; small household appliances contributed RMB 116 million (13.1%); and home improvement and building materials generated RMB 94.17 million (10.7%).

The prospectus indicates that WOOK's primary downstream customers are distributors, and its main revenue source is the distribution channel, accounting for 82.8%, 73.7%, and 69.5% of total revenue in 2023, 2024, and the first three quarters of 2025, respectively. In recent years, with the expansion onto e-commerce and live-streaming platforms, WOOK has also gained more individual consumer customers.

WOOK stated in the prospectus that the net proceeds from the IPO will primarily be used to enhance the supply chain warehousing and logistics network, expand marketing and channel networks, boost brand influence, pursue digital upgrades, establish localized teams and talent training, and serve as general working capital.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com