Q&Me: TikTok Shop Rapidly Catching Up with Shopee in Vietnam, Both Deepening the 'Value-for-Money' Niche

Ebrun Original, January 8th: Recently, Vietnamese market research firm Q&Me released a new report providing a systematic comparative analysis of the performance of Shopee and TikTok Shop in Vietnam's e-commerce market. The report covers the period from January 1 to November 30, 2025.

It indicates that in a highly competitive market environment, both platforms are intensifying efforts in user acquisition, merchant support, and transaction scale expansion, accelerating the concentration of Vietnam's e-commerce market.

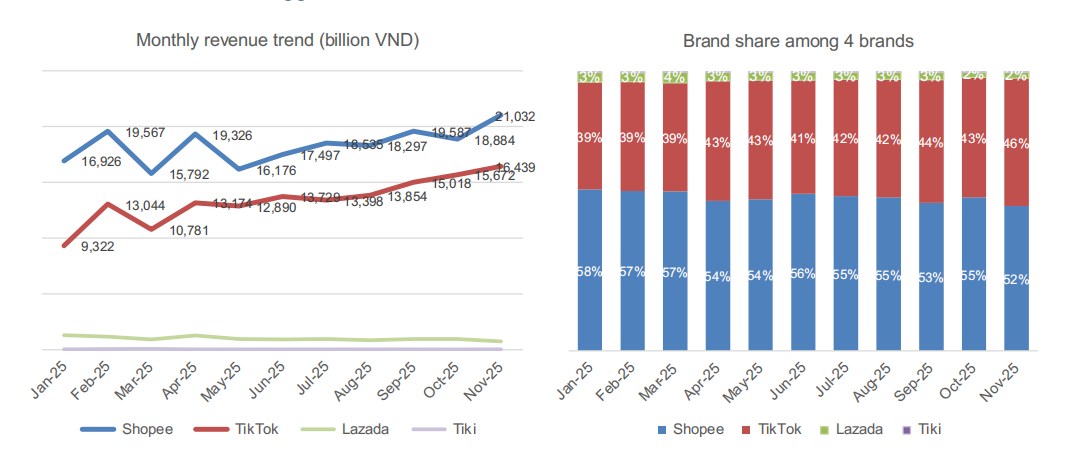

From an overall perspective, Vietnam's e-commerce market has shown a clear 'duopoly' trend. Shopee and TikTok Shop together account for approximately 98% of the market share, with Shopee holding about 52% and TikTok Shop reaching 46%. Against this backdrop, the survival space for other platforms is further squeezed, with Lazada and Tiki seeing their market competitiveness continue to weaken, maintaining low market shares of 2%-4% and 2%-3%, respectively.

In terms of sales performance, Shopee and TikTok Shop maintained intense competition throughout 2025, with their revenue scales being close and alternating leads across multiple months. In contrast, the monthly revenue of Lazada and Tiki is significantly lower, and their market presence continues to decline. Q&Me believes this change reflects that Vietnam's e-commerce market is rapidly evolving from 'multi-platform competition' to 'top-heavy concentration,' with traffic, merchants, and transactions converging toward the most scalable and efficient platforms.

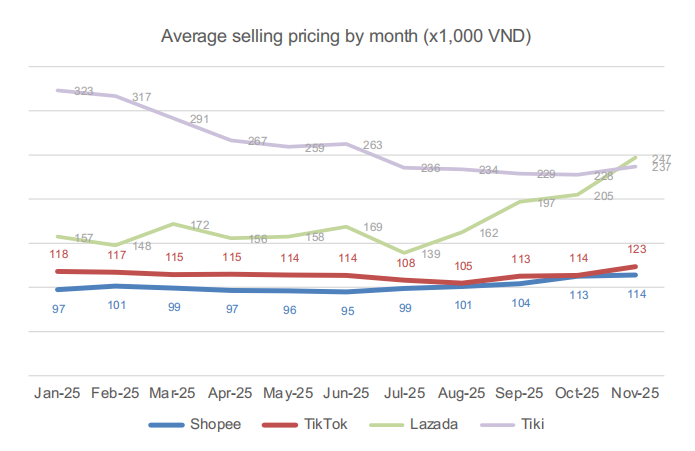

Regarding pricing strategies, both Shopee and TikTok Shop position 'value for money' as their core competitiveness. Data shows that the average transaction price on both platforms has long remained in the range of 100,000-120,000 Vietnamese dong, significantly lower than other e-commerce platforms. In comparison, the average selling price on Lazada and Tiki is noticeably higher, even exceeding 300,000 Vietnamese dong in some months, further reinforcing Shopee and TikTok Shop's positioning as 'low-price platforms' in consumers' minds.

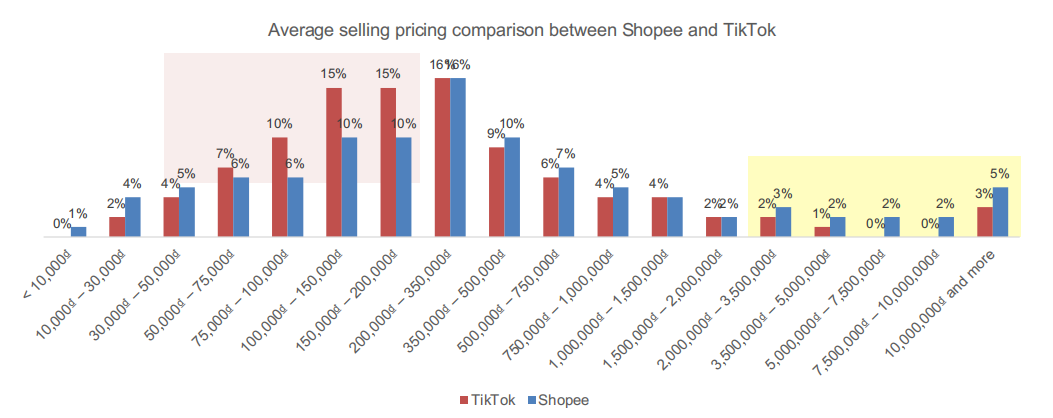

However, despite both emphasizing low prices, they have shown clear differentiation in price band layout and consumption scenarios. TikTok Shop's orders are highly concentrated in the low-price segment below 350,000 Vietnamese dong, with products mainly consisting of women's apparel, fashion accessories, and fast-moving consumer goods, emphasizing impulse-driven purchases and instant conversions fueled by content. Shopee, on the other hand, covers a broader price range from low to mid-high, maintaining a significant advantage in the 3.5 million to 10 million Vietnamese dong and even higher price segments, making it a key platform for high-value goods and brand-driven consumption.

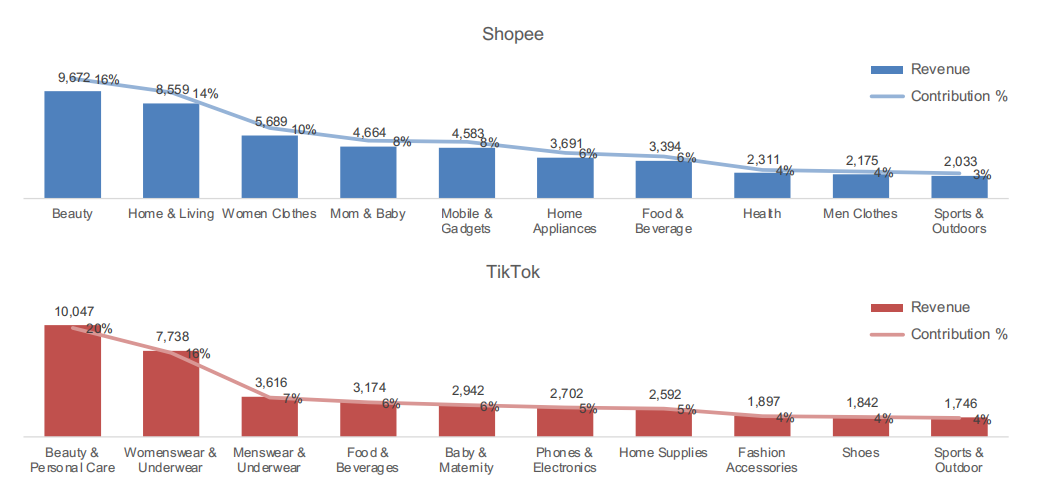

In terms of category structure, differentiation is also evident. Based on category sales over the past 90 days, TikTok Shop's sales are highly concentrated in fashion categories, with apparel, beauty, and food & beverages contributing significantly to overall transactions. Shopee's category structure is more balanced, with strong performance not only in fashion and beauty but also in home & living and IT & electronics. This difference reflects the distinct focus of the two platforms on consumption scenarios: TikTok Shop leans more toward an 'instant shopping' experience where 'content equals consumption,' while Shopee functions more like a comprehensive e-commerce platform, catering to users' planned and diversified consumption needs.

In terms of core growth drivers, beauty and women's apparel have become shared engines for both platforms. However, TikTok Shop's sales contribution from categories like fashion and food & beverages is significantly higher than Shopee's, indicating its advantages in content-driven discovery and short-video conversions are steadily materializing. Shopee, through its broader category offerings and more mature fulfillment system, maintains overall structural stability.

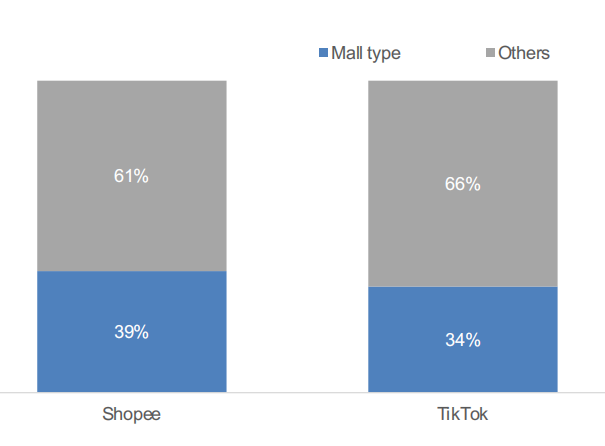

In store structure, Shopee still leads in brand and official store presence. Data shows that Shopee's Mall official stores account for 39%, higher than TikTok Shop's 34%. In contrast, TikTok Shop has a higher proportion of non-official stores, aligning with its social commerce ecosystem and partly explaining its concentration in the low-price product segment.

Ebrun will continue to track this development. To learn more about related information, please scan the QR code to follow the author on WeChat.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com