Temu Introduces New Deposit Rules: Focus on Three Categories Including Children's Toys, Mobile Power Banks, and Memory Cards, with Maximum Deposits up to 100,000 Yuan

Ebrun Original | December 27 News: According to merchant feedback, Temu recently released new "Deposit Rules" in its backend, significantly adjusting deposit standards for three key categories: children's toys, mobile power banks, and memory cards. Industry insiders believe this move not only aims to regulate seller operations but also reflects the platform's intention to proactively manage potential risks.

Under the latest rules, the deposit for the children's toys category has been uniformly increased to 10,000 RMB across 39 countries and regions, the deposit for mobile power banks and batteries has been raised to 30,000 RMB, and the deposit for memory cards has been increased to 10,000 RMB.

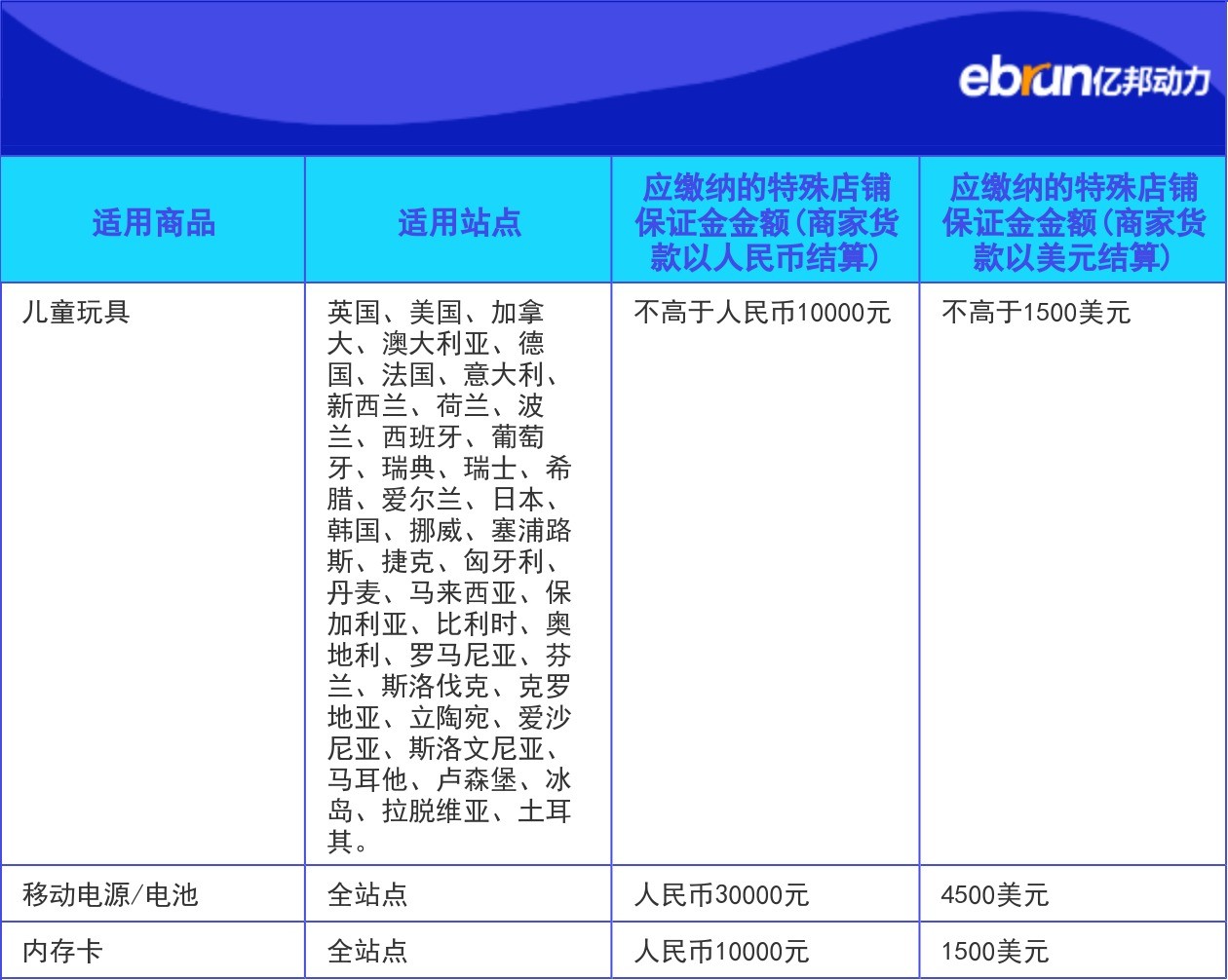

| Applicable Products | Applicable Sites | Special Store Deposit Amount (Merchant Settlement in RMB) | Special Store Deposit Amount (Merchant Settlement in USD) |

| Children's Toys | United Kingdom, United States, Canada, Australia, Germany, France, Italy, New Zealand, Netherlands, Poland, Spain, Portugal, Sweden, Switzerland, Greece, Ireland, Japan, South Korea, Norway, Cyprus, Czech Republic, Hungary, Denmark, Malaysia, Bulgaria, Belgium, Austria, Romania, Finland, Slovakia, Croatia, Lithuania, Estonia, Slovenia, Malta, Luxembourg, Iceland, Latvia, Turkey. | Not exceeding 10,000 RMB | Not exceeding 1,500 USD |

| Mobile Power Banks/Batteries | All Sites | 30,000 RMB | 4,500 USD |

| Memory Cards | All Sites | 10,000 RMB | 1,500 USD |

Additionally, the new rules set two general terms for sellers in all categories:

If a store or product receives a recall or warning from regulatory authorities, the deposit will directly increase to 100,000 RMB (approximately 15,000 USD);

If violations such as failed product testing, falsified qualifications or intellectual property rights, or deliberate concealment of product information (e.g., covering logos on images or physical products) occur, the deposit will be increased to between 10,000 and 100,000 RMB (approximately 1,500 to 15,000 USD) depending on the severity of the violation.

Notably, the children's toys and mobile power bank categories have long been industry focal points: Previously, Temu had already increased the deposit for children's toys in the European market to 30,000 RMB and strengthened qualification controls for power banks, issuing a "Notice on Stricter Power Bank Qualification Controls."

In contrast, the memory card category is a new compliance focus. Its inclusion in key supervision mainly stems from widespread industry issues such as "capacity-expanded drives" and falsely labeled drives. Some sellers modify firmware to disguise memory cards with actual capacities of only tens of GB as 1TB or even 2TB products, which not only leads to frequent disputes but also affects the overall credibility of the 3C category.

Industry analysis suggests that Temu's new deposit rules aim to increase sellers' compliance costs, strengthen risk prevention and control, and guide market standardization, thereby helping to reduce the platform's overall operational risks and protect consumer rights.

The specific deposit general rules are as follows:

General Rules

1.1 Given that both parties intend to further clarify facts related to deposits and are committed to enhancing buyer experience, improving customer satisfaction, and complying with all applicable laws and regulations, the merchant (hereinafter referred to as "Merchant") hereby acknowledges and agrees to these "Deposit Rules" (hereinafter referred to as "these Rules"). These Rules are incorporated into the Merchant Agreement, as amended from time to time, and form part of the Merchant Agreement.

If you accept these Rules (including but not limited to confirming acceptance by clicking the "I have read and agree" button; the language and expression of the aforementioned button may be adjusted based on the merchant page display), it means you have carefully read the services under the Merchant Agreement and are deemed to have fully understood, comprehended, and agreed to be bound by all contents of these Rules.

If you do not agree to these Rules, it will be considered that you have decided to no longer use the services we provide, and the Merchant Agreement and these Rules will be terminated in accordance with the relevant provisions of the Merchant Agreement.

You further confirm that by clicking the "I have read and agree" button or by starting/continuing to use any services under the Merchant Agreement, you acknowledge that you have been reminded and are aware of the important terms in these Rules displayed in bold font, and, under the premise of fully understanding the above terms, you have been fully informed, understood, and are willing to be bound by all contents and terms of these Rules and this clause.

1.2 Unless otherwise specified, these Rules may not be used to adapt to terms that have the same meaning in the Merchant Agreement.

1.3 Deposits under these Rules are calculated and paid on a per-store basis. Store deposit (the specific name is subject to the display on the merchant center page) refers to funds paid by the merchant or a specific store to us to ensure strict compliance with these Rules, the Merchant Agreement, other merchant rules, any other agreements between the merchant and us and/or our affiliates, any applicable laws and regulations, and any representations, warranties, or commitments made by the merchant to buyers. These funds are used for compensation or remediation to buyers, us, our affiliates, and/or other third parties when the merchant has not violated these Rules, the Merchant Agreement, other merchant rules, any other agreements between the merchant and us and/or our affiliates, any applicable laws and regulations, or any representations, warranties, or commitments made by the merchant as a buyer to buyers.

1.4 Store deposits shall be paid in the manner indicated on the merchant center page. All third-party fees incurred during the process of paying, replenishing, compensating, or refunding store deposits (including but not limited to bank handling fees) shall be borne by the merchant.

1.5 The merchant shall ensure that the source of funds used to pay store deposits is legal and that the merchant has the legal right to dispose of such funds. If the store deposit is paid by a third party, the merchant guarantees that the third party is clearly aware of the nature and purpose of the payment and agrees to make the payment, and guarantees that the funds will not be subject to any third-party mortgage or deposit claims or return requests, nor shall any guarantee liability be assumed.

1.6 We are not required to pay any interest to the merchant on store deposits.

Ebrun will continue to track and report on this information. To learn more about related details, please scan the QR code to follow the author's WeChat.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com