Amazon Discloses Seller Tax Reports for the First Time; Data Discrepancies with Backend Are Common

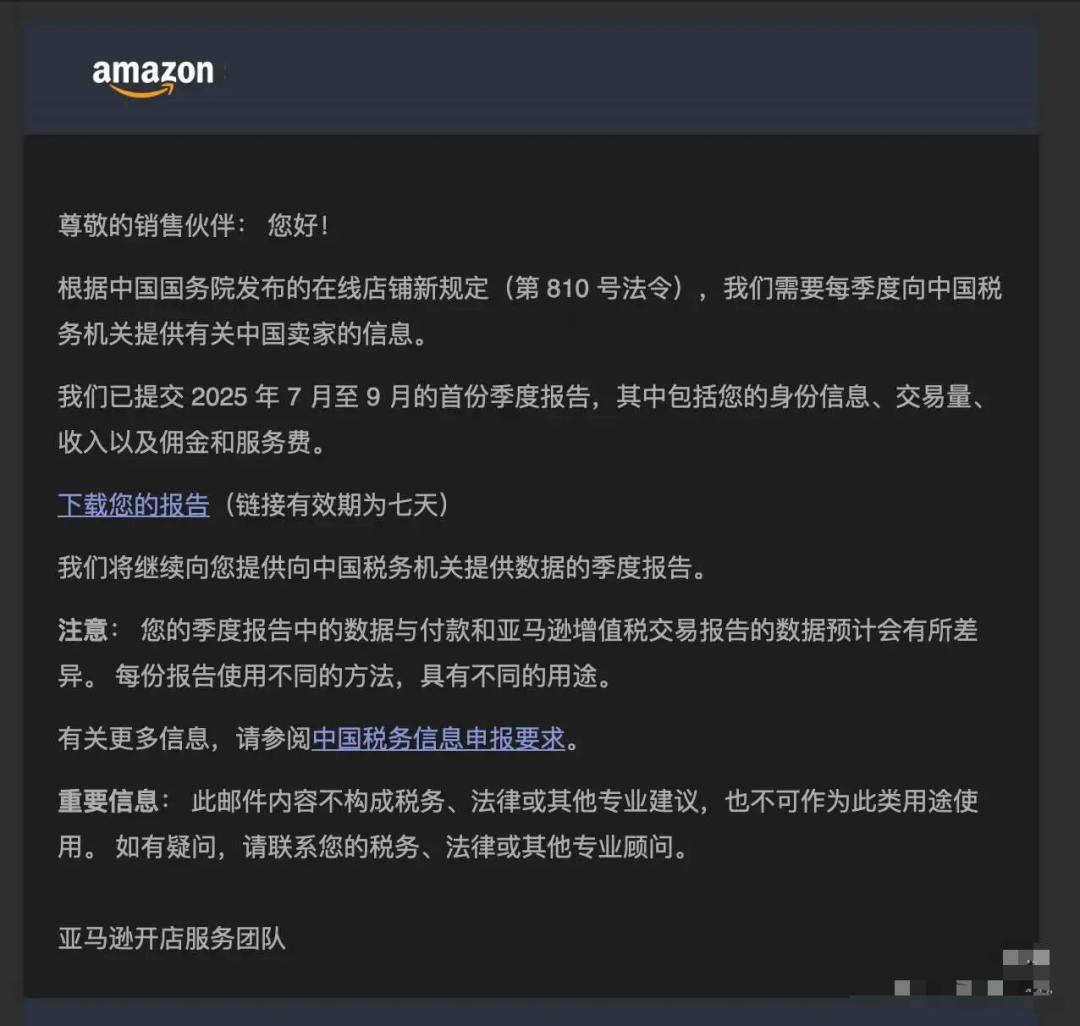

Ebrun Exclusive: On December 23, many sellers reported receiving an email from Amazon titled 'View Your China Tax Report for July to September 2025.'

The email stated that, in accordance with China's State Council regulations for online stores (Decree No. 810), platforms are required to provide information about Chinese sellers to Chinese tax authorities on a quarterly basis. The email clarified that Amazon has submitted its first quarterly report for July to September 2025 and provided sellers with a download link for the report.

By clicking the 'Download Your Report' link, sellers can view the data Amazon submitted to the Chinese tax authorities, which includes 10 dimensions of information: seller mark, Amazon site, company name, unified social credit code/taxpayer identification number, quarter, total revenue, refund amount, net revenue, total commission and service fees paid to the platform, and number of transactions (orders).

According to seller feedback, when verifying data with tax authorities in the past, the Amazon sales figures displayed in the tax system were often higher than the net income shown in the backend. The data reporting standards used by the platform for tax authorities have long lacked transparency, making it difficult for sellers to analyze discrepancies and provide effective explanations to tax authorities.

In response to this issue, Amazon specifically highlighted in the email that data in the quarterly tax report may differ from that in the seller payment report and the VAT transaction report, due to variations in the statistical methods and purposes of different reports.

Supporting explanations indicated that differences mainly arise from revenue calculation methods, aggregation timing, and the scope of definitions for revenue and expenses.

First, there are significant differences in revenue calculation methods.

The revenue in the tax report is not based on the net income or actual received amounts commonly used in the backend but is aggregated by order. For example, in 'Amazon Fulfillment Revenue Calculation,' the platform calculates global sales revenue based on the central platform exchange rate on the day the order is delivered to the buyer. Therefore, even for the same transaction, the settlement amount in the backend may not fully match the tax report.

Second, differences in aggregation timing can also lead to numerical discrepancies.

The quarterly tax report typically uses the order shipment date to determine the reporting period, while sellers often rely on settlement cycles or payment cycles for daily reconciliation. As a result, the same order may be allocated to different time periods, causing data misalignment across reports.

Additionally, the definitions of revenue and expenses vary.

The 'revenue' scope in the quarterly tax report is broader, including not only product sales revenue but also shipping fees, gift wrap fees, discounts, taxes, and surcharges.

The total commission and service fees include referral fees, fulfillment fees, cross-border shipping fees, regulatory advertising fees, and monthly subscription fees.

Regarding data discrepancies, a tax service provider noted, 'It is common for sellers to find discrepancies when verifying Amazon's official reports.'

He explained that when reviewing Amazon's reporting logic (including tax amounts and not subtracting refunds), discrepancies exist across various stores. Sellers do not need to strive for complete consistency with Amazon's backend data, as long as their own revenue recognition logic complies with tax requirements and remains consistent.

Ebrun will continue to track this development. To learn more about related information, please scan the QR code to follow the author on WeChat.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com