Selling 2 Billion Items in 90 Days, and Delivering Them within 48 hours, Amazon Fights Against "Four Dragons" with a "Killer Move"

By He Yang

In 2007, Amazon founder Jeff Bezos said in an interview that he was often asked, "What will change in the next five to ten years?" instead of "What will not change in the next five to ten years?". But what he wants to answer, or what can better guide Amazon's action direction, is the latter.

"Consumers want more choices, lower prices, and faster delivery speeds—this will not change," Bezos said. "I can't imagine that ten years from now our customers will say 'I love Amazon, but I wish they could deliver the goods to me a little more slowly'."

This explains why Amazon launched the Prime membership service in 2005, providing members with exclusive benefits and "two-day delivery" free shipping, and introduced FBA (Fulfillment By Amazon) in 2007, providing its proprietary logistics fulfillment capabilities to third-party sellers, further enriching the range of Prime products.

Seventeen years later, what Bezos said "will not change" still influences Amazon's strategic decisions.

In April this year, Amazon CEO Andy Jassy once again emphasized the importance of "more products, lower prices, and faster speeds" for the growth of the e-commerce business in the annual shareholder letter. Amazon now has hundreds of millions of products for sale (increasing by tens of millions in 2023 alone), saved customers nearly $24 billion through various promotions in 2023 (nearly a 70% increase from the previous year), and delivered over 7 billion items on the same day or the next day in 2023 (almost a 70% increase from the previous year).

"Faster speed" has been highlighted by Amazon as particularly important. Faced with the competitive challenge from the "Four Little Dragons" (AliExpress, Tmall Global, SHEIN, and TikTok Shop) which achieved significant supply chain efficiencies through a fully managed model, it needs a significant move to widen the gap with its peers, despite having achieved the fastest speed in history in 2023. Amazon has made it clear that it aims to further speed up in 2024.

"The faster we deliver goods to customers, the more frequently they will come to Amazon to shop," Andy Jassy said.

The logistics timeliness role in driving order growth is undeniable. Not only Amazon, but the "Four Little Dragons" are also advancing logistics speed, including promoting "semi-managed" to recruit merchants with overseas warehouses for stocking, launching self-operated logistics services to streamline the delivery process, and strictly requiring sellers to ship goods within a specified timeframe. Not just e-commerce platforms, traditional retail giants such as Walmart and Target are also striving to achieve faster and higher-quality delivery services through various investments..

A race is underway that involves sellers, service providers, and also all platforms. However, in the entire cross-border e-commerce industry, faced with the reality of slowing market growth and declining purchasing power, as platforms try to address this with "faster" and "more cost-saving" solutions, sellers, who are pressured from both ends by costs and pricing, will face what kind of challenges?

01

Leading the Charge, Amazon Ups the Pace Again

According to data, in the first quarter of this year, Amazon again set a new record for Prime member delivery speed, delivering more than 2 billion items on the same day or the next day. By March 2024, in more than 60 large cities in the United States, 60% of Prime member orders were delivered on the same day or the next day, a significant increase from 50% in the same period last year. In London, Tokyo, and Toronto, 75% of Prime member orders can be delivered on the same day or the next day.

This efficiency is clearly leading in all cross-border e-commerce platforms. Around 90% of sellers on Amazon ship through FBA, which means stocking overseas in advance. When consumers place orders, goods are dispatched from the country, significantly reducing the logistics time for cross-border shopping. Compared to some major platforms that mainly use cross-border direct mail small parcels (with a delivery time of 1-2 weeks), the speed advantage is obvious.

From Amazon's measures, shortening delivery distance, improving inventory layout, and continued investment in "same-day delivery" service facilities are the key to further acceleration currently.

For example, the warehousing fee policy implemented by Amazon in March this year is a strong stimulus. It charges different level fees for different inventory configuration options chosen by sellers, prompting sellers to allocate inventory distribution to more warehouses in eight major regions across the country, from the previous practice of only storing inventory in the two major regions of East and West USA.

The underlying logic is to further promote regional operations by subdividing operation centers and delivery networks into smaller and more serviceable regions to use inventory more efficiently. At the same time, it enhances the match between goods and regional operating centers, distributing goods to locations closer to customers.

In addition to promoting sellers to work with operational network optimization, technical upgrades are also crucial to ensure efficient operation in each regional center. For example, last year, Amazon introduced a robot storage system called Sequoia at one of its logistics facilities in Texas to speed up inventory identification and storage. According to official information, this system, after integration with other related technologies, can reduce order processing time by 25%. Therefore, Amazon is now expanding this system to more logistics facilities this year.

Amazon's dedicated sites for "same-day delivery" are also continuing to expand. Currently, Amazon provides same-day delivery services in more than 110 cities and regions in the United States and over 135 towns in Europe. Based on this, Amazon has stated that it will set up more sites in major US cities this year (55 are already in place), and will include more products in the same-day or next-day delivery service range globally.

Continuing to expand the construction of logistics and delivery networks is the foundation for Amazon to speed up in the global market. It covers more rural customers and flexibly adjusts delivery models in densely populated areas (such as using bicycles, walking, and picking up goods from local businesses (such as grocery stores)), enhancing the Prime Air drone delivery capabilities, and more, are all part of Amazon's 2024 plan.

In addition, the "Amazon 2024 Export Cross-Border Logistics Accelerator Plan" launched in late May is Amazon's strengthening of global supply chain solutions with its self-operated logistics. A key aspect of this is "speeding up"—"Amazon Global Logistics will speed up customs clearance processes at European destinations. For example, after the upgrade of the customs clearance process on the Germany-UK route, the average time from goods arriving at the port to clearance will be reduced to approximately 2 days."

Ultimately, Amazon's continuous acceleration is not just a result of its enormous business flow supporting the logistics system, but also inseparable from heavy investment in infrastructure over the years:

· In terms of warehousing network layout, as of the end of the third quarter of 2023, Amazon has more than 185 distribution centers worldwide, distributed in 11 countries including the United States, Canada, the United Kingdom, France, Germany, Italy, Poland, and Spain.

· As for hardware fulfillment, in terms of air transportation, Amazon has its own air cargo network—Prime Air service. As of October 2023, the number of freighters has reached 110 (for comparison, SF Express had only 87 all-cargo aircrafts put into operation by March 2024); in ground transportation, Amazon owns approximately 100,000 gasoline-powered delivery trucks globally and nearly 280,000 delivery drivers. By October 2023, Amazon became the largest electric delivery fleet in the United States with 10,000 electric delivery trucks. In addition, Amazon has delved into the shipping domain, manufacturing containers, chartering private cargo ships, and so on, to address the impact of insufficient external shipping capacity resources on delivery efficiency.

· In terms of logistic technology, apart from redesigning more efficient logistics centers and distribution networks, Amazon has formed a leading edge in intelligentization. For example, according to Ark Invest statistics, Amazon's number of robots is increasing at a rate of about 1,000 per day, and the current number of robots is roughly one-third of the total number of employees.

Looking back on Amazon's layout in logistics, several key points can be extracted:

First, in 2007, the introduction of FBA empowered third-party sellers with Amazon's own logistics and fulfillment capabilities. At the same time, by combining "Prime membership + FBA," platform traffic increased rapidly—Prime membership service initially increased user stickiness, while FBA provided a good logistics experience, driving more consumer choices towards Prime membership. In turn, a larger order quantity further promoted the expansion of FBA.

The second is the official establishment of a self-built logistics system in 2014, gradually ending the situation where previous order deliveries could only rely on UPS, FedEx, and other third-party logistics providers.

The third is after the outbreak of the COVID-19 pandemic in 2020, Amazon seized the opportunity to expand its e-commerce penetration, building hundreds of new warehouses, sorting centers, and other logistical facilities to nearly double the scale of its logistics network.

The ongoing "warehouse splitting" is a new point, signifying the arrival of the "regional operation" era for FBA—by dividing the US market into more and smaller delivery zones, the distance and time spent for parcel delivery is reduced. This allows for more orders to be delivered on the same day or the next day.

To quote an industry insider: Amazon's long-term strategy for improving logistics efficiency is firm, forming a moat through year-round infrastructure construction. On one hand, it has raised the standard for cross-border e-commerce logistics, pushing other platforms forward, while on the other hand, faster delivery speed allows Amazon to further compete with offline retailers.

02

Sprint vs Bargain, which is more powerful?

Of the four competition dimensions in the e-commerce platforms—"more, faster, better, and save"—"fast" and "save" are probably the most attractive to the general consumer. In the competition between the "Four Small Dragons" and Amazon, the "Four Small Dragons" clearly tend to focus on "save".

Temu is the most thorough in implementing pricing strategies. For example, the basic pricing of its products is typically around 85% of identical products on Amazon, and there is a dynamic price comparison mechanism for the same products across the platform. Even if Temu doesn’t have advantages on all three dimensions of "more, faster, better," but with "save" alone, Temu has made a breakthrough in the cross-border e-commerce market like thunder and lightning, setting a sales target of 60 billion US dollars for this year (a year-on-year growth rate of over 230%)—this volume is far less comparable to Amazon, but you should know that Temu has been online for less than three years.

SHEIN has always been a representative of "ultimate cost-effectiveness"—it became popular in the beginning because it was able to make the same style of clothing at a price that was only half of similar fast fashion brands such as ZARA and H&M. AliExpress and TikTok Shop also rely on a "semi-managed" model, through platform intensive operations to maximize efficiency, and to bring goods to overseas consumers at lower prices.

Comparatively, Amazon's bet seems to focus more on "speed." It bets that faster delivery speed can change the frequency of consumers shopping on Amazon. Logistics is also part of the product's competitive advantage, with natural time barriers. In terms of "more," "better," "save," other platforms may be catching up closely or have already overtaken, but only "fast" is the most difficult to surpass, and it won’t take a day or two. When Amazon is faster, other people will have a hard time catching up, and then its moat will naturally become deeper.

Of course, the "Four Small Dragons" have not been negligent in logistics.

Temu started to build part of its own logistics from last year, including building overseas warehouses, entering sea transport, and so on. There is also news this year that Temu is cooperating with some airlines to solve the problem of inadequate transportation capacity through purchasing cargo planes. At the same time, since the launch of the "semi-managed" business in March, Temu has almost all turned its core forces to "semi-managed," and it's important to emulate Amazon's local delivery—"semi-managed" can use goods stored in overseas warehouses and the local delivery capabilities of third-party service providers, significantly improving the speed of logistics while saving funds and time.

TikTok Shop has started operating FBT (Fulfillment by TikTok), providing a one-stop service through a self-built logistics system, simplifying the seller's delivery process. On the other hand, it has also imposed higher requirements on sellers’ delivery speeds. For example, since June, orders placed before 12:00 PM must be marked as "shipped" by 11:59 PM of the same working day.

SHEIN continuously invests in the construction of smart logistics industrial parks and overseas warehousing centers, and launched the "QuickShip" logistics service for the European market last year, reducing the delivery time of some products from the previous two weeks to 4-6 working days. Meanwhile, SHEIN also launched the "semi-managed" mode in May this year, similar to the "semi-managed" model of Temu, it can absorb the local delivery capabilities of merchants and third-party service providers to speed up logistics.

AliExpress has the help of its sibling Cainiao. In the past two years, it has been equally stonewalled on logistics timeliness. At the end of June last year, AliExpress and Cainiao jointly launched a product called "Global 5-Day Delivery," which has landed in five key countries and regions in less than three months, and has expanded to ten countries by April of this year. In addition, since February 19th this year, AliExpress has expanded the "48-hour delivery" time to the world (previously many regions had 72-hour delivery).

This "roll-speed" trend is blowing not only among several cross-border e-commerce platforms, but some retail giants have joined in this logistics race.

For example, Target launched a plan called "Target Circle 360" at the beginning of this year, providing free same-day delivery and even one-hour delivery services for orders over 35 US dollars, and the remaining orders can basically be delivered within two days. In addition, there are also free returns and other services.

Walmart announced at the beginning of this year to expand the scope of its existing drone delivery service, capable of delivering goods to consumers in some areas within half an hour, and through the Walmart GoLocal (delivery-as-a-service) platform, providing same-day delivery services to more than 200 stores across the United States, etc.

Back to the "roll-price" situation of the Four Small Dragons, under high inflation in the United States, whether it is the online retail representative Amazon or the offline retail representatives Walmart and Target, they all "fought" to varying degrees:

· Walmart CEO Doug McMillon stated in the latest quarterly earnings conference call that the company has reduced prices on nearly 7,000 products;

·TARGET announced price reductions on about 5,000 popular products, including daily groceries and household essentials;

· For its self-operated business, Amazon launched a discount activity on AmazonFresh of up to 30%, covering 4,000 products, and introduced a new service called Amazon Access in May, which is positioned to serve low-income customers with a variety of discount plans and payment methods. For its third-party seller business, Amazon has announced multiple times this year a reduction in sales commissions for some low-priced goods, at 12 sites worldwide.

Undoubtedly, no consumer can refuse lower prices and faster delivery. For platforms, no one can have it both ways at two dimensions; perhaps it’s just a matter of finding a way to compete in order to maintain their attractiveness in consumers' hearts.

03

Countering the global consumption downgraded, what gives?

"The platform competes in speed and low prices with consumers at its center, which is not wrong, but a large part of the pressure will shift to the sellers. For the sellers, improving user experience is the core of returning to business nature and promoting development, which is also not wrong, but the current problem is when market incremental is insufficient, focusing on cutting variable costs seems to be the only way out," as assessed by a cross-border seller.

"Without enough profit, who would have the time and strength to improve quality?" he added. This may also represent the thoughts of a large number of sellers. At the same time, whether sellers have the aspiration and strength to keep pace with the platforms in the tug-of-war between the Four Little Dragons and Amazon is also a concern.

Needless to say, the "price war", driven by market consumption and platform, has become a foregone conclusion, shrinking sellers' profit margins. And when the call for sped-up platform logistics is made, the sellers' end may be in for a new round of shuffling.

As for Amazon logistics, the biggest change this year is undoubtedly the "warehouse splitting fee" policy mentioned earlier. The changes in the back-end logistics delivery network, along with the reset of the front-end algorithm, helps Amazon speed up while also forcing sellers to improve efficiency and bear more inventory and transit costs – you have to allocate enough inventory to more regional warehouses for better delivery time and in return, obtain traffic support.

"Storage, store allocation service fee; good sell but no inventory, low inventory fee; too much unsold inventory, monthly warehousing fee, surpassing inventory additional fee; good sell but lots of returns, return handling fee...," a seller laughed bitterly, "this requires very high professional supply chain management capabilities for sellers, including inventory turnover, accurate inventory, and safe stock guarantees, among others. Failure to meet these requirements results in additional costs."

Other platforms have similarly raised more stringent standards for logistics timeliness. Failure to meet these standards often affects store weight, traffic size, and some platforms even penalize for delayed shipment.

Looking across several cross-border e-commerce platforms, Amazon can be said to be consistently "calm". As industry insiders put it: In the face of the Four Little Dragons' fierce offensive, Amazon is unlikely to make a direct counterattack - at present in terms of scale, even if it does not make radical adjustments, it can still hold onto the market, and racing may be a kind of "reduction in dimensions".

"But for Amazon sellers, there are two main problems: one is 'internal conflicts', including the consumption between the platform and the sellers (such as increased costs), and the internal competition among sellers; the other is 'external conflicts', the Four Little Dragons' attacks to some extent take away some of Amazon's market share, leading to even tighter traffic supply, sellers urgently seeking new traffic exports, and 'running away' is not excluded under a difficult survival situation. But where can they go without survival anxiety?" further analysis by the aforementioned person.

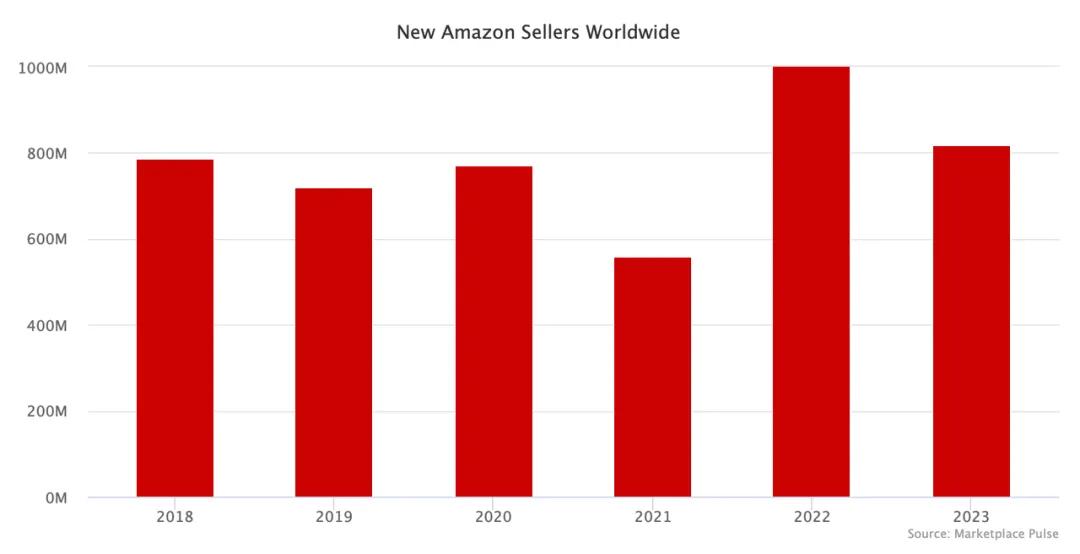

(Chart showing the number of newly added Amazon sellers from 2018 to 2023. Information is from Marketplace Pulse.)

Undeniably, sellers' expectations for Amazon are still very high. Compared to the Four Little Dragons' "full hosting", "semi-hosting", which squeezes prices, and requires sellers to make concessions on "autonomy", Amazon provides more freedom and brand value imagination.

But the challenges facing Amazon are also diverse and complex. Internally, the platform is gradually entering a mature stage, the number of sellers is getting larger, and the layers are becoming more obvious, with the focus being placed on earning brand budgets or safeguarding the small and medium-sized seller market, and different strategies need to be adopted, and sometimes trade-offs must be made between the two.

From an external environment perspective, with the fact that global purchasing power is declining, in the next few years, the "low price" trend in the global market seems unavoidable. However, no merchant is willing to compete on prices. If the Four Little Dragons' strategy is to seize the opportunity of global consumption downscaling and give full play to the comparative advantages of Chinese manufacturing, can Amazon lead merchants more effectively to resist global economic downturn?

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.