120 Days of Roller Coaster! Inside Story of TikTok Sellers in Indonesia | Southeast Asia Cross-border Insights

By Zhou Xinyi

Editor: He Yang

[Ebrun Original] "It was like a sudden dousing of cold water on a blazing fire, and everyone immediately plunged into the darkest moment," described one seller of the TikTok Shop Indonesia when it was shut down in mid-October last year.

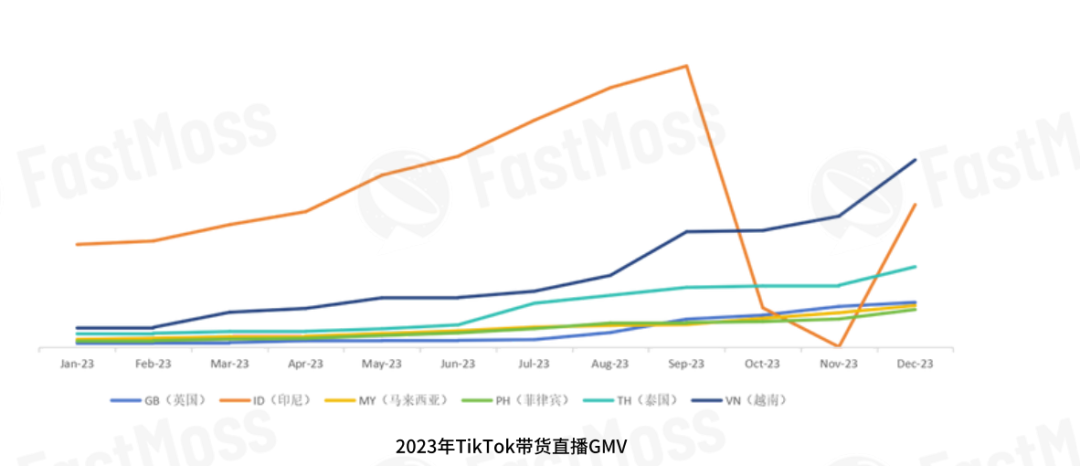

It was supposed to be a peak season, with Double 11 just a month away. In the same period in 2022, after a successful Double 11 event in six Southeast Asian countries, TikTok Shop experienced a surge of online shopping frenzy. As the first stop of TikTok Shop in Southeast Asia, Indonesia performed exceptionally well during the event. Only on November 11th, the GMV of live streaming e-commerce increased by 408%.

No one could have predicted that the Double 11 in 2023 would turn out this way. "Some sellers who were doing well had monthly sales of over ten million, only to plummet to zero all of a sudden. Some were still waiting for their Double 11 stock to arrive, but the channels were gone. Many merchants and MCN institutions (in the TikTok e-commerce business) stopped operations directly, some had to turn to other platforms, while others disbanded and quit," the aforementioned seller recalled.

Like riding a roller coaster, two months later, the resolute sellers still in place saw the light at the end of the tunnel. TikTok finally made a comeback in the Indonesian e-commerce market on Double 12 through a strategic partnership with the local tech giant GoTo (integrating their e-commerce departments TikTok Shop Indonesia and Tokopedia into a new entity, controlled by TikTok).

"Sales surged immediately upon the return! Orders for January are already scheduled for February and March," one seller exclaimed after the return of TikTok Shop on Double 12, feeling the familiar sensation of skyrocketing sales, restocking, influencer marketing, and live streaming e-commerce all in full swing.

Source: Fastmoss 2023 TikTok Ecological Development White Paper

However, a series of adjustments and changes are still ongoing behind the crisis. On the one hand, the platform's mode of operation has not yet been finalized, and Indonesian entities continue to raise objections to the conduct of e-commerce by social media platforms. Consequently, the e-commerce transaction system and backend operations of merchants may be transferred from TikTok Shop to Tokopedia, with the possibility of ultimately switching from a closed-loop shopping process to an external link redirection. On the other hand, localization of merchants has become a necessity, including the introduction of more local Indonesian merchants to adjust the overall merchant structure, as well as the need for a thorough transformation to localize a large number of Chinese cross-border merchants.

The return of TikTok Shop in Indonesia seems to have opened a new chapter, no matter how you look at it. All participants in the entire ecosystem, including merchants and institutions, are reacquainting and re-understanding this market and its business—a reshuffle that cannot be avoided. At the same time, some new faces have emerged. Since last year, Indonesia has seen the emergence of many "assembly plants" that collaborate with Chinese supply chains in order to meet the localization demands of Chinese merchants in Indonesia.

01

From single-channel, single-site

to walking with "multiple legs"

In February 2021, TikTok launched its e-commerce business in Indonesia as its first global station. As the second-largest station in the TikTok global network, Indonesia has 125 million monthly active users (MAU). After the initiation of its e-commerce business, the entire ecosystem rose rapidly, attracting a large number of local and Chinese merchants, as well as a surge in live streaming hosts and MCN institutions.

Vicky, a women's clothing category seller, joined TikTok Shop Indonesia in 2022. Her strategy in the Indonesian market was a pure live streaming mode, importing white-label products from Guangzhou to local warehouses, and nurturing local hosts in her own live streaming room. She once surged into the top ten category ranks.

At the beginning of this year, Vicky also established branch offices in Malaysia and Thailand, and her business was running smoothly. Today, as she shuttles between the three locations, her busy figure shows no signs of the helplessness when TikTok Shop Indonesia was shut down last year. "It was quite a blow to us at the time, but everything is back on track now, and we are doing even better," she said.

"Anyone who has been in cross-border for a while knows that 'you can't put all your eggs in one basket,'" quipped a seller who had witnessed the 2021 "account suspension wave" of Amazon and experienced the closure of TikTok Shop Indonesia. During the two months when TikTok Shop Indonesia was closed, he shifted his focus to Shopee and Lazada—fortunately, he had already set up his stores. This year, he also plans to reposition his business on the Shopee and Lazada platforms, no longer simply transferring products sold on TikTok to those platforms.

Comparatively, Kevin, a seller who was only operating on the TikTok Indonesia platform at the time of closure, faced a much more severe situation. When he received news of the platform's closure, he was in the midst of a period with an average monthly GMV of 10 million RMB. The sudden interruption of business would naturally disrupt the original business rhythm, but for some reason, Kevin believed "this should only be a temporary pause." "I have to do business in the Indonesian market, otherwise it would not justify the previous significant investment," he recalled.

Without much hesitation, Kevin quickly set up a team to operate a shelf e-commerce, opened stores on several major platforms, and continued to use short videos of TikTok to drive traffic, only this time using external links to facilitate transactions. Now, he has achieved his target of 10 million RMB in monthly GMV, and his sales on shelf e-commerce platforms are steadily increasing.

"The twists and turns of (TikTok Shop) now seem like nothing, and can even be seen as a push for us to develop more capabilities," Kevin shared. This year, he plans to continue to expand his channels, not only covering online platforms but also looking for opportunities offline. At the same time, he is confident in replicating the experience of dominating sub-categories in the TikTok department, and developing more explosive products.

Of course, some merchants left or were just about to start but had second thoughts about TikTok Shop Indonesia. The reason for most of these merchants is only one—they found that the cost-effectiveness of this market was no longer high. As one seller put it, "The phenomenon of making quick money has become a thing of the past."

This is partly due to the tightening of policy supervision. For example, the virtual delivery model that once accompanied cross-border e-commerce is gradually exiting the stage, and local stocking and local stores are gradually becoming the norm on various platforms.

The increasing starting cost is another factor. Some sellers pointed out that the cost of starting a TikTok e-commerce business in Indonesia was about 1 million RMB in 2021 (including the costs of influencers, advertising, logistics, warehousing, etc.); this doubled to 2 to 3 million RMB in 2022, and reached 6 to 7 million RMB in 2023. Today, this figure is likely even higher.

02

Hidden dangers in Indonesia's new e-commerce regulations

Local compliance becoming the "magic spell"

Even though it stagnated for two months, TikTok Shop Indonesia still contributed the highest GMV among all open stations last year, according to Yipit Data and CMB International Securities. In 2023, TikTok's e-commerce GMV had a 28% share, with Indonesia being the first among existing open stations. It was followed by a 22% share in Thailand and 17% in Vietnam.

Although the platform and merchants' transaction volume has been steadily increasing, the impact of the new e-commerce regulations is still significant. The integration of TikTok Shop with Tokopedia does not mean that everything is settled, as Indonesia's Minister of SMEs and Cooperatives, Teten Masduki, publicly stated: "Although TikTok is investing in Tokopedia, the platform still allows direct transactions on social media channels, and TikTok's e-commerce business, TikTok Shop, still violates local regulations in Indonesia (Trade Minister's Regulation No. 31/2023)."GoTo, the parent company of Tokopedia, responded at a public briefing in February, stating, "Full compliance is in progress, and will be completed in a month and a half (i.e. in April)." At the same time, it mentioned that partnerships with TikTok could make Tokopedia the leading e-commerce player in Indonesia. Currently, Tokopedia has over 100 million monthly active users, holding a market share of 35% in the Indonesian e-commerce market, second only to Shopee.

In terms of collaboration, the TikTok Shop Indonesia site may become a combination of social media and e-commerce outbound links. This raises two key concerns for merchants:

· First, the integration of TikTok Shop with Tokopedia signifies not only the technical migration of the TikTok Shop merchant back-end management system to Tokopedia, but also the need for TikTok Shop merchants (especially Chinese merchants) to adapt to Tokopedia's platform rules, which have stricter requirements for localization and compliance.

· Second, completing transactions via outbound links differs in user experience from closed-loop transactions, and the conversion rates under these two models may also vary.

Several merchants told Ebrun that the merger of the two entities may involve a relatively straightforward technical integration such as the migration of the merchant back-end management system and the transition from presenting "TikTok Shop Mall" to "Tokopedia Mall" on the front end, even the shift from "closed-loop" to "outbound links" may not be an issue. However, becoming part of Tokopedia's merchant management system presents a significant challenge.

As an Indonesian local e-commerce platform, Tokopedia has never opened its doors to foreign merchants before. For Chinese cross-border merchants, the threshold for opening a store on Tokopedia is naturally higher than that of a global platform like TikTok. For example, merchants need to provide three basic types of information: KTP (identity card), NPWP (taxpayer identification number), and SIUP (trade business license). Additionally, all products sold on Tokopedia need to undergo SNI certification (the Indonesian national standard, a product certification system led by the Indonesian National Standardization Agency BSN) and have user instructions and product descriptions in Indonesian.

Among these, the most sensitive requirement for merchants is the possession of NPWP (taxpayer identification number). "This means you need to be regulated by the Indonesian tax system, just like a company with a physical presence in Indonesia, and are subject to the supervision of business turnover within the Indonesian tax system, involving tax-related issues. However, Indonesia has not yet clearly defined the policy for taxing e-commerce enterprises," pointed out a merchant in the beauty category at TikTok Shop.

Similar situations have occurred in other Southeast Asian countries. In February this year, Nguyen Van Chuc, the director of the Vietnamese tax authority, proposed that if the annual online revenue of an e-commerce seller exceeds 100 million Vietnamese dong (approximately $4,000), they would be required to pay value-added tax and personal income tax. Subsequently, the leading e-commerce platform Shopee announced that Vietnamese site sellers must accurately and completely update tax and identity information through the seller channel before 23:59 on February 29, 2024. Sellers who fail to upload the relevant information on time will have their Shopee account balance locked.

In addition, starting from January 1, 2024, Malaysia will levy a 10% low-value goods tax on online sales of low-value imported goods not exceeding 500 Malaysian ringgit (approximately $106).

"If the hidden benefits of tax for cross-border e-commerce sellers disappear, costs increase, and price competitiveness decreases, the operating manner will undoubtedly need to be adjusted," the merchant added. "A real moment of local transformation has arrived."

03

Supply Chain Migration Sparks "Assembly Plant" Boom in Indonesia

After the upheavals at TikTok Shop Indonesia, the localization process for merchants here has progressed much faster compared to other Southeast Asian markets. This is particularly evident in the supply chain.

"In the second half of last year, Indonesia saw some factories closely coordinated with the Chinese supply chain, undertaking the final stage of product production—assembly," reviewed a seller in the 3C category. In contrast to the products of Vietnam and Mexico assembly plants, which mainly export to the European and American markets, the products of Indonesian assembly plants circulate in the local market.

According to Raymond's observations, the local Indonesian supply chain is an extension of the Chinese supply chain, where the technical and material links are still managed by Chinese factories, with light assembly and packaging done in Indonesian factories.

Raymond's company, Onelink Media, founded by Indonesian overseas Chinese, has abundant local supply chain resources and also cooperates with Chinese factories. "After the platform's sales volume explodes, there may be a shortage of resources and goods, which requires more support from Chinese factories," he said.

Starting from last year, the 3C category seller has been planning to collaborate with Indonesian overseas Chinese to establish a local assembly plant. He once organized domestic supply chain technical personnel to inspect local factories to assess the possibility of implementing domestic factory assembly SOP. "Cooperation needs to be cautious; the first step of the plan is to start with simple material assembly and packaging," he told Ebrun.

At the beginning of this year, considering the low labor costs and the difficulty in product assembly in Indonesia, the seller decided to implement a plan of "mainly manual assembly in the early stage, with a salary system of base salary + piece-rate, and considering automated assembly by machines in the later stage."

In practice, the seller found that the cost of "Chinese supply chain + Indonesian assembly plant" is higher than the entire production process of the Chinese supply chain, and the scale efficiency, efficiency, and employee work efficiency of the Indonesian factory are not as good as those of the domestic factory. However, this is something that must be done.

Another beauty category seller also indicated that Indonesian assembly plants cannot keep up with the rhythm of surging sales at TikTok, leading to longer replenishment cycles and "time-consuming adjustments."

For the 3C category seller, doing business with the Indonesian local supply chain has two significances: first, it reduces the pressure of capital turnover—sending goods from China to Indonesia by air freight is costly, and sea freight takes 45-60 days, implying slow turnover of goods and significant pressure on stocking funds; second, it is necessary for brand development. Local supply chain compliance is an indispensable part of branding.

"There are opportunities for brands in the Indonesian market, and consumers are beginning to focus on the quality of products," explained the seller, emphasizing that many domestic brands on Tmall have begun to localize their layout in Indonesia, while many teams have brought the domestic Douyin E-commerce mode to TikTok, rapidly boosting sales with short videos, inflow ad investment, and KOL promotion.

It is evident that three months after the return of TikTok Shop Indonesia, the players still in the game have become "more mature" and "more stable." After gaining a clearer view of this market, they are gradually delving deeper into their business in Indonesia.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.