Retreat? Advance! A New Era for China's E-commerce in Southeast Asia

By Wang Yu

Edited by He Yang

[Ebrun Original] From the launch of TikTok Shop's mall business (shelf e-commerce), attempting to compete with traditional e-commerce giants; to the ripple effect caused by Temu, accelerating the development of the "fully managed" model in Southeast Asia; and to the unexpected joy of Tokopedia in Indonesia's market turmoil, forming an alliance with TikTok and completing integration... In 2023, e-commerce giants are flocking to Southeast Asia.

For "gold diggers" emerging from the aftermath of the pandemic in the Southeast Asian market, the competitive situation is not becoming clearer, but rather more complex. Can the new forces stand firm? How can the old forces catch up? Everything is unpredictable.

However, there is no doubt that the fiercely contested market share between the "new nobility" and the "old money" proves the profitability of this market. Accompanying this is a series of more profound structural changes: localization is imperative, regulatory compliance is imminent, and monetization is pressing...

Amidst the dramatic changes, businesses are facing a major divide between "the strong advance and the weak retreat." The era of grassroots heroes making money in Southeast Asia through unconventional means is fading, and only those who are fully prepared, both visibly and behind the scenes, can continue to charge forward.

Ebrun Power has sorted out the important changes in the Southeast Asian e-commerce field over the past year, hoping to gain insight into the competitive situation, development opportunities, and future trends.

01

Transition Between the Old and the New, How Do the Defending and the Attacking Sides Respond?

In 2023, the Southeast Asian e-commerce field remains as busy as ever at this "crossroads," but what's different from before is that the "race" between major platforms has become increasingly fierce and cruel. Those who lose not only lose market share but also directly exit the game.

Having been on par with Shopee and debuting in Indonesia in 2015, JD's Southeast Asian business (launched in 2015 in Indonesia and in 2018 in Thailand) announced on January 30, 2023, that it would stop accepting orders from February 15, 2023, and cease e-commerce services from March 31, 2023, "in order to concentrate resources on building infrastructure and supply chains."

As a once strategic project, JD once had its glorious moments in the online retail market in Southeast Asia: the compound growth rate once reached about twice that of local e-commerce, with the number of partners exceeding 30,000; 85% of orders in Indonesia could be delivered the next day, and in the capital region, this number exceeded 98%.

But after Shopee and Lazada intensified their competition in 2018, JD's business in Indonesia began to shrink. In just three years, its GMV plummeted from sixth place to tenth place; by the end of 2022, JD's website only ranked 13th in terms of visits.

Although the JD.ID (JD Thailand) platform no longer exists, its extensive logistics system remains firmly entrenched in this land as a remnant of its Indonesian business: JDL Express Indonesia still operates with 11 warehouses, over 250 delivery points, and more than 3,000 internal couriers before the platform shutdown. These resources coupled with over 20 logistics parks invested by JD constitute the "ammunition depot" for this giant to continue to compete in the logistics race in Indonesia.

In comparison to JD, the delisting of fashion industry B2B platform Zilingo was somewhat embarrassing: layoffs, internal strife, wage arrears, and financial scandals have made this once unicorn enterprise one of the biggest blow-ups in the Southeast Asian e-commerce field in recent years.

"Zilingo's story illustrates the heavy consequences for a platform that failed to seize the opportunity, quickly rise to the top, and find a stable niche," said an investor.

While these platforms have declined and exited the market, the remaining players still on the battlefield, who are trapped in the internal and external environment, have ushered in the most intense "showdown."

In February 2023, TikTok Shop made the first move, officially launching its "mall" business in Southeast Asia, combining the shelf e-commerce and content e-commerce into one.

TikTok has always been proud of its massive natural traffic. However, for ordinary businesses, effectively capturing this traffic is not a simple matter. Before forming content production capabilities, helping sellers pass through the teething period and providing substantial order volume has become a major obstacle. The appearance of the "mall" solves this problem.

As part of TikTok Shop's growth strategy in 2023, the entrance of the "mall" is set on the platform's homepage, providing sellers with a new traffic exposure resource in addition to live streaming and short video.

The appearance of the shelf area allows TikTok to not only follow the existing mode of "finding goods," but also open up the closed loop of "finding people for goods." For most cross-border sellers, the latter is undoubtedly a more familiar mode, can dispel their concerns about joining TikTok, and is conducive to a quick connection and alignment of popular products, enhancing the richness of the platform's product supply.

This not only brings a new period of prosperity for Southeast Asian businesses, but also provides impetus for TikTok to "peak" in Southeast Asia. According to Momentum Works, TikTok Shop's market share in Southeast Asia in 2023 was about 13.9%, an increase of 215% from the previous year. According to an internal source, the "mall" will contribute at least 50% of this growth rate, which is equivalent to $7.5 billion in GMV.

It can be said that TikTok has brought immense pressure to platforms such as Shopee and Lazada. Cube Asia pointed out that in Indonesia, Thailand, and the Philippines, consumers reduced their spending on other platforms after shopping on TikTok, with Shopee decreasing by 51% and Lazada by 45%.

What makes the traditional platforms feel even more threatened is not just TikTok alone. Temu, an overseas platform under Pinduoduo, is also making waves in Southeast Asia with the "fully managed" model that swept through Europe and the United States.

In August 2023, after two months of brewing, Temu selected the Philippines as its first stop in its foray into Southeast Asia. Over the next few months, Temu also successively went live in Malaysia and Singapore.

Although the newcomer Temu has not yet had a significant impact on GMV and market share compared to its predecessors, the formidable "fully managed" tactic it wields has truly made people apprehensive: in the already not very lucrative Southeast Asian market, whether the fully managed model will once again start a "price war" is a question that worries all parties.

At the same time, Lazada and Shopee successively launched their own "fully managed" models. However, an industry insider stated, "The significant tension between promoting the transaction price and platform awareness and the cost-effectiveness of the fully managed model is a considerable test."

02

Stringent Compliance Pressure Looming

How to Steady the Line in the Wave of Localization?

If there is one piece of news that had the biggest impact on the Southeast Asian market in 2023, it would undoubtedly be the shutdown and subsequent reopening of TikTok Shop Indonesia.

On September 27, 2023, the Indonesian Ministry of Trade officially announced the revised "Minister of Trade Regulation No.31 of 2023." The regulation stipulates that social media cannot be used as a platform for product sales; at the same time, Indonesian e-commerce platforms are required to set a minimum price of $100 for products purchased directly from abroad; in addition, it also involves the sale of imported goods in Indonesia needing to comply with whitelist requirements, and e-commerce platforms cannot sell self-owned products, and other regulations. A few days later, TikTok Shop's Indonesia site announced its official closure.

This event not only disrupted TikTok's expansion in the Southeast Asian market but also triggered a "migration" of seller groups - a large number of sellers sought refuge in the arms of traditional giants such as Shopee and Lazada. These platforms also released signals to assist "displaced" sellers.

For example, Lazada provided benefits such as three months of zero commission, two months of free shipping, and seller solution points worth 300,000 Indonesian Rupiah for newly registered sellers who were seeking to "reestablish themselves."

However, if this event is simply viewed as "TikTok falling down and the competitors getting a share of the pie," it would underestimate the widespread shock caused by the new Indonesian policies. In addition to mandating the separation of e-commerce and social media businesses, other regulations restricting the online sale of imported goods may be more damaging and have a greater impact on all e-commerce sellers.

Shopee subsequently announced that it would gradually stop displaying and selling cross-border goods on its Indonesian site. In addition, Shopee's overseas warehouses and third-party warehouses in Indonesia have also stopped accepting cross-border sellers. On the other hand, Lazada issued a notice stating that all products that conflict with Indonesia's latest regulations would be delisted.Even more eye-catching is that the "compliance storm" sparked by Indonesia has not been limited to the country, but has triggered a remarkable "domino effect." For example, the Malaysian government announced that it would impose a 10% tax on low-value imported goods sold online from 2024, and the service tax would also be increased from 6% to 8%.

It can be said that in the face of the looming compliance pressure in 2023, compliance with local laws and regulations and allowing the local business ecosystem to share in the booming development of e-commerce has become an important issue that cannot be ignored. Major platforms are actively moving towards "localization".

TikTok formed an alliance with the local Indonesian platform Tokopedia, making TikTok Shop a local company in Indonesia. Shopee has cracked down on pseudo-local shops (referring to cross-border sellers who imitate local Southeast Asian businesses and pretend to be "local shops" without local inventory), and vigorously promoted a new local fulfillment model. Lazada has begun to attract investment for the full-service management (ISC) of local stores, which differs from the original full-service model mainly in the requirement for participating businesses to have local stock, local fulfillment, and a local entity.

03

Capital withdrawal? Light battles?

Where is the road to self-rescue for the giants?

In November 2023, Google, Temasek, and Bain jointly released the 2023 Southeast Asia Internet Report (e-Conomy SEA). The report pointed out that the funding amount in Southeast Asia had dropped to the lowest point in six years, and 88% of investors believed that they were facing a more difficult exit environment.

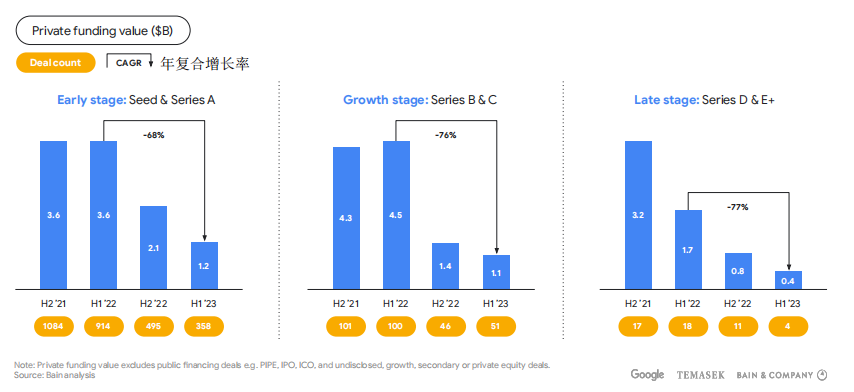

From fervor to calm, the retreat of international hot money seems to have become an irreversible trend within the Southeast Asian market. Specifically, within just one year, the total amount of seed and Series A financing has decreased by 68%, and the total amount of D+ round financing has decreased by 77%.

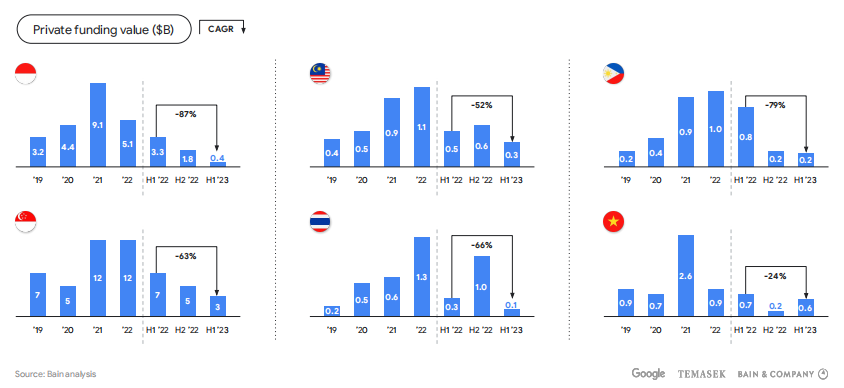

Compared to the previous year, the average decline in the total financing amount of the six Southeast Asian countries in 2023 exceeded 60%. Among them, Indonesia's "avalanche" was the most severe, dropping from $3.3 billion in the first half of 2022 to $400 million in the same period of 2023, a staggering 87% contraction. The contractions in the Philippines, Singapore, and Thailand were also greater than 60%.

After the capital withdrawal, the strategy of burning money to compete for market share is no longer sustainable. "To escape the financing winter, digital enterprises in Southeast Asia need to demonstrate that high-quality exits with reliable pathways are easily obtainable... Reasonable profit paths and sustainable unit economics have become key conditions for Southeast Asian digital businesses to traverse the low tide," the report pointed out.

In fact, for e-commerce giants, the new focus has shifted from "growth at all costs" to monetization that can turn losses into profits. In response to this, several mainstream e-commerce platforms in Southeast Asia have embarked on difficult explorations and transformations. However, while they have achieved some results, they have also experienced a series of setbacks in the trial and error process.

As the leading player in the Southeast Asian e-commerce platform, Shopee started its profit monetization attempts in the third quarter of 2022.

In the following year, Shopee took drastic measures, including shutting down its European business, streamlining its workforce, and increasing commission rates. The following three consecutive quarters of positive profits confirmed the effectiveness of these contraction strategies.

However, in September 2023, a strongly worded company-wide letter from Lee Xiao Dong, CEO of Shopee's parent company Donghai Group, seemed to signal that the company was about to change course again. "We have achieved financial independence, which means we no longer need to rely on external capital to pursue growth... Now that we have completed this arduous task, let us lead the company to new heights—the next chapter of our growth journey."

In the letter, Lee stated that the company would enter "full battle mode" and prepare to reinvest, even if "this means the company may incur losses in some quarters." In line with this statement, Shopee's finances in the third quarter of 2023 once again changed from profit to loss.

Perhaps the encroachment of TikTok and Temu, as well as the prolonged struggle with its old rival Lazada, have made the "champion" that has been firmly seated in the Southeast Asian e-commerce market for many years feel uneasy, to the point of leaning towards the latter option of "positive profit" and "pursuing the enemy."

Lazada's business adjustments may need to rely more on the full support of its parent company, Alibaba Group. In 2023, Alibaba continued to bet heavily on the Southeast Asian market: in April, it injected $353 million; in July, it injected $845 million; and in December, it injected $634 million, totaling more than $1.8 billion.

At the same time, Lazada underwent a new round of high-level leadership changes: in July 2023, Lazada Group's Chief Business Officer, Sheng Huan, took over as the new CEO of Indonesia, and in August, Lazada Singapore's president, Lu Wei Li, resigned. In January 2024, Lazada Thailand also plans to replace its CEO.

Furthermore, Lazada also underwent a large-scale downsizing. Industry insiders analyzed that this move is likely to pave the way for Lazada's future combat plans—internally, Lazada is breaking down and reconstructing the middle-tier organizations of its national subsidiaries, consolidating their management under the headquarters, which inevitably led to a reduction in personnel size.

It is worth mentioning that in addition to Lazada and Shopee, another Indonesian "Fourth Player" ecommerce platform, Bukalapak, also began downsizing and tightening expenses in 2023.

As a well-established platform where 99% of employees are from Indonesia, Bukalapak began working on monetization soon after it went public in 2021, making it one of the earliest companies among mainstream platforms to realize the urgency of positive profitability. By the third quarter of 2023, it had reduced the percentage of affected employees to about 5% of its total workforce. This layoff was also seen as an important step for Bukalapak to further tighten the gap and prepare to achieve profitability in the fourth quarter.

04

Beyond the storm's eye, some players successfully ring the bell

Despite the withdrawal of capital, financing in the cross-border e-commerce ecosystem in Southeast Asia has not completely sunk into a depression. There are still players who have received capital favor outside of the storm center. Among them, the two most noteworthy IPOs are the logistics giant Jitu based in Indonesia listing on the Hong Kong Stock Exchange and the community group-buying newcomer WEBUY GLOBAL, founded in Singapore, listing in the United States.

Jitu was established in Jakarta, the capital of Indonesia, in 2015. Its founder, Li Jie, was once a key member of OPPO's expansion into the Southeast Asian market and fully understood the importance of logistics in this later-developing region. Founded by Li, Jitu quickly became the second-largest express delivery company in Indonesia, and then expanded its business to other Southeast Asian countries.

Based on the 2022 parcel volume, Jitu has become the top-ranking express service provider in Southeast Asia, with a 22.5% market share and a compound annual growth rate of 47.6%, making it the leader in Southeast Asia.

On October 27, 2023, Jitu Express was officially listed on the main board of the Hong Kong Stock Exchange, with an issue price of HK$12, and raised a total of HK$3.528 billion in global sales.

If Jitu's listing represents the long-term development of Southeast Asian e-commerce infrastructure, WEBUY's listing relies more on its refined community group-buying operation model.

In the same month as Jitu's listing, WEBUY landed on the Nasdaq in the United States and issued 3.8 million shares of common stock at an issue price of $4 each, raising $15.2 million. In the following two months, WEBUY maintained a high position and even reached a peak of $6.26.

For a Southeast Asian community group-buying platform that has only been in existence for four years, achieving such results on the US stock market is already quite remarkable. Looking back at the market moves of this young company over the past few years, it is easy to see that it has operated with precision.

This is closely related to the deep industry accumulation of its founder Xue Min. Xue, the former Chief Strategy Officer of ezbuy (a comprehensive e-commerce platform in Southeast Asia), participated in the construction of the full-chain infrastructure of social e-commerce, including marketing, website design, and logistics and fulfillment, and is extremely familiar with the "social + retail" model.

Under his cultivation, WEBUY has maintained high-speed growth since its establishment. In the past two years, its revenue has doubled, and losses have continued to narrow. In particular, the platform's performance in the Indonesian market is even more remarkable, with its revenue in the Indonesian market achieving an astonishing 435.7% growth from 2021 to 2022, with hardly any similar competitors to match its progress.In addition, Southeast Asian e-commerce companies that announced their plans to sprint for IPO in 2023 also include aCommerce from Thailand, and the B2C e-commerce platform Tiki from Vietnam.

aCommerce, founded in 2013, is a provider of end-to-end e-commerce solutions such as omnichannel retail, performance marketing, and channel management. It is currently one of the largest integrated service providers in Southeast Asia. Tiki, established in March 2010, started with the sale of e-books and gradually expanded to cover a wide range of product categories. The company is renowned in Vietnam for its unique TikiNow service, which offers 2-hour delivery.

New consumer brands are making a strong push into South East Asia, with cross-border B2B finding new growth points. In recent years, businesses from China have been a major factor influencing the development of the Southeast Asian market. From capital investment to infrastructure and brand exports, it is evident that Chinese enterprises have deeply integrated into this emerging market. In 2023, Chinese businesses' momentum for "breaking into Southeast Asia" shows no sign of slowing down.

In terms of market segments, the strongest entries are in new consumer categories such as trendy toys, coffee, and tea drinks.

As a leader in the trendy toy sector, Pop Mart opened flagship stores in Malaysia and Thailand in May and September, and has established a supply chain in Vietnam. Its international president, Vincent Wen, also indicated that by the end of 2023, 70% of the stores will be opened in East Asia and Southeast Asia, with plans underway for Indonesia, the Philippines, and other countries’ markets.

"Top Coffee Brand" Luckin Coffee has made substantial inroads into the Singapore market, opening thirty stores in one year. Its competitor, Pacific Coffee, has adopted a "wide net" strategy, successively entering Indonesia, Thailand, Vietnam, Malaysia, and Singapore.

In the tea drink segment, Nayuki Tea has chosen Thailand as its first stop for entering Southeast Asia, while the high-end freshly brewed tea representative Heytea has also launched its first store in Malaysia.

Another notable segment is the B2B platform. In 2023, both 1688 and Alibaba International made new progress in Southeast Asia.

In December, 1688 cooperated with VelaCrop and launched the B2B platform "SaboMall" in Vietnam, providing Chinese source products to local sellers, covering various small and medium-sized product categories. Henceforth, local sellers can directly order goods on the 1688 website and have them shipped to Vietnam.

Alibaba International seized the changes brought about by the new e-commerce regulations in Indonesia and launched the "S Plan" for businesses affected by the new regulations and Southeast Asian e-commerce policies, releasing a comprehensive support plan, offering traffic, operations, logistics, and other support for all Chinese cross-border sellers in the Southeast Asian B2B market.

Before the plan was launched, Alibaba International was fully prepared to welcome Southeast Asian businesses: the nationalized operations were fully launched, and the Southeast Asian national pavilions were opened, allowing customers from various countries to see a shopping interface that is more in line with local language habits, product styles, and interaction modes.

It is reported that in early September 2023, within two weeks of the launch of the national pavilions, more than 5,000 industrial and trade-based sellers flooded in, vying for the Southeast Asian market. The diversity of categories in the zone also quickly improved, gathering more than 6,000 different kinds in a short period.

Another noteworthy move comes from the cross-border logistics giant Cainiao International.

As early as 2021, the company proposed an ambitious long-term logistics plan, stating that it would establish an unprecedented scale of intelligent warehousing network in Southeast Asia, and the Cainiao Hub, as an important node, covers nearly 2.5 million square meters of land.

In August 2023, Cainiao finally made a significant move in Indonesia by opening its first warehouse in the Greater Jakarta area. The logistics base was named the "Cainiao Cikarang Logistics Park".

This warehouse is the third warehouse completed in the Cainiao Southeast Asia regional warehouse network and is the largest Cainiao hub in Southeast Asia to date, consisting of six high-standard warehouses with a total construction area of 180,000 square meters and a leasable area of 170,000 square meters.

Cainiao's "big infrastructure" in Indonesia has also aroused strong interest from local businesses, reaching a 75% occupancy rate shortly after its operation. Among the tenants are also powerful large enterprise customers, such as Wuling Indonesia, CJ Logistics, Klog, Haier, and Lazada.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.