A "Surprise" Market Worth $160 Billion: Both Alibaba and Pinduoduo Make a Move

By Wang Haoran

Edited by He Yang

[Ebrun Original] If you experienced the "cross-border shopping" craze in China during the years 2014-2016, you must still remember how popular some products from South Korea were, such as cosmetics. Now, a "reverse cross-border shopping" trend has emerged between China and South Korea, with Korean consumers enthusiastically snapping up Chinese goods on cross-border e-commerce platforms.

AliExpress, under the Alibaba Group, has become a "celebrity" frequently seen by Korean consumers over the past year, and in December last year, it surpassed domestic giants 11st and Gmarket to reach the second place among overseas e-commerce platforms in South Korea, setting a record. Accompanying this is the Choice label—this is a new map owned by AliExpress (fully managed, with a display page in the forefront), which, in the minds of consumers, signifies lower prices and better service, and was once called "Ant Hell" by Korean netizens (to describe being addicted to it).

In July 2023, another Chinese e-commerce platform known for its low prices, Temu, also entered the South Korean market, bringing the "Shop like a billionaire" experience from the U.S. to Korean consumers, adding even more stories to this market. Here, Temu achieved 2 million downloads in just 88 days, and from July to November, it ranked first in the e-commerce shopping app download rankings for over 60 days.

Plagued by high commodity prices, high interest rates, and a high exchange rate, the Korean consumer market finds it difficult to resist these temptations from overseas. One Korean consumer candidly said, "I placed an order for products worth over a million Korean won (from a Chinese e-commerce platform) just lured by the advertisements. They are just too cheap!"

Television, Instagram, Line, Facebook... you can see the presence of these two platforms on almost all online channels. A local e-commerce practitioner in Korea mentioned to Ebrun that advertisements for AliExpress are almost visible on various platforms almost every day. Seoul's subway is also filled with people carrying AliExpress delivery boxes—Mar Dong-sik, a nationally renowned star in Korea.

Behind the heavy deployment of platforms in the front-end market, more Chinese merchants are also pouring in. Zhao Haicheng, who operates overseas warehouses in South Korea, told Ebrun that since the second half of last year, products from platforms such as AliExpress and Temu have caused South Korea's customs warehouses to "overflow" several times.

In a warehousing incident in June 2023, the Korean Customs Service stated that the working hours of Incheon and Pyeongtaek ports were extended from 9 a.m. to 6 p.m. to midnight, and the time required for customs clearance alone had extended to 2-3 weeks, with the number of packages waiting at major ports and airports reaching 600,000 to 700,000. Most of these packages came from China.

Behind the high growth, some doubts have also emerged: Why are AliExpress and Temu investing heavily in this small country? For Chinese cross-border sellers, is this suddenly booming market a new promised land or a wolf in sheep's clothing?

01

AliExpress Makes a Move, Temu Enters

Ultra-low prices stir the South Korean e-commerce market

Korean consumers refer to products from overseas as "cross-border shopping" or "overseas direct purchase," similar to the positioning of Tmall International and JD Worldwide in China.

Korea, a country with a population of only 50 million, is roughly the size of Jiangsu Province in China and relatively scarce in local resources, relying heavily on imports. Relevant data shows that Korea's annual import scale is over $10 million, and there are a total of 1,176 products for which the country's dependence on specific countries exceeds 50%, with 584 products mainly imported from China.

Although Korea ranks 28th in the world in terms of population, its e-commerce market size ranks among the top globally. According to various statistics, in 2022, there were about 40 million online shopping users in Korea (accounting for about 80% of the total population), and the size of the e-commerce market was around $160 billion, almost equal to the total e-commerce scale of the entire Southeast Asia, ranking fourth globally. As of early 2023, Korea's internet penetration rate is as high as 97.6%.

However, according to Yong Yang, the person in charge of AliExpress's South Korean market, despite the huge market size, Korea has not yet formed a true e-commerce "oligopoly."

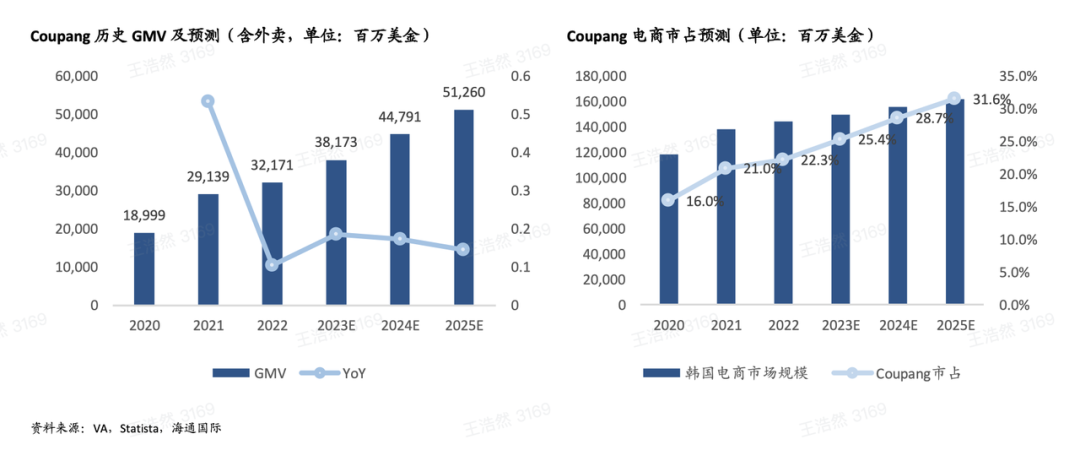

Currently, the leader in this area is Coupang, known as the "Korean version of Amazon," which occupies approximately 20% of the market share as a comprehensive e-commerce platform. Coupang started recruiting Chinese sellers to join in 2019, offering two types of shop openings: cross-border and local stores. Official data shows that in October 2023, Coupang's monthly active users on the Android platform reached 20 million, 3.42 times higher than the second place.

Another major player is Naver, Korea's largest search engine. Naver's market share in Korea even exceeds that of Google, combining search, social, e-commerce, and local services, with Naver Shopping being one of the most commonly used shopping apps by Koreans.

"I guess almost all of these local e-commerce platforms in Korea have the presence of Chinese sellers," said Zhao Haicheng.

Constrained by the dominance of local players, it has been difficult for foreign e-commerce platforms to gain a significant foothold in Korea. Prior to 2023, few foreign platforms had made it to the top of the shopping app download rankings in Korea.

A turning point came in 2023. A business model known as "full-service" that has been widely adopted by Chinese e-commerce platforms has caused a stir in overseas markets. By controlling the supply chain, using economies of scale to reduce the costs of operation, promotion, freight, and end delivery, and unifying the user experience, it brings consumers the ultimate value for money. AliExpress and Temu represent this model.

It is this model's advantage of low prices that propelled AliExpress and Temu to quickly rise in the South Korean e-commerce rankings over the past year. According to survey data released by the South Korean mobile app analysis service provider, Wiseapp, as of November 2023, the number of new users for AliExpress and Temu in Korea ranked first and second: AliExpress gained 3.71 million new users, with an active user count of 7.07 million in November alone; Temu gained 3.54 million new users, with a growth rate ranking second, increasing fivefold from August.

Other data shows that the usage rates of AliExpress and Temu in various shopping apps are 66.6% and 68.7%, second only to the South Korean domestic e-commerce platform Coupang (91%).

In March 2023, AliExpress announced at a press conference held at the Korea Exhibition Center that it would invest 100 billion Korean won (approximately RMB 530 million) in the Korean market. At the same time, AliExpress began to focus on user experience, including hiring actor Mar Dong-sik to be the spokesperson in Korea, collaborating with Cainiao to launch the 5-day delivery service in Korea, and announcing an investment of 10 billion Korean won to crack down on counterfeit goods on the platform and protect consumer rights, among other measures.

In addition, Yong Yang stated that AliExpress is working on localization, including improving the front-end page of the app, language, and the entire operations team.

According to official data, within a month of the launch of the Choice channel, AliExpress's orders grew by more than 50% year-on-year, and the growth in orders from South Korea exceeded 100%.

A screenshot from the backend of an AliExpress merchant received by Ebrun Power showed that one day in January 2024, the top three countries in the visitor rankings on the backend were Spain, South Korea, and Brazil. These happen to be AliExpress's key markets in 2023.

Under the sweeping wave of low prices, AliExpress and Temu have led the way in the growth of downloads and user numbers in the South Korean e-commerce market over the past year. However, price-sensitive consumers often show little loyalty—where the prices are lower, they go there, so how to solve user retention issues and establish brand loyalty is a challenge these platforms must face.

(Photo: Traffic data for some South Korean e-commerce platforms)

Zhao Haicheng pointed out that the status of AliExpress and Temu in the minds of South Korean consumers is similar to what Pinduoduo was to Chinese consumers a few years ago: for inexpensive products, they go to AliExpress and Temu; for high-quality, high-priced branded goods, they go to Coupang, or some niche e-commerce platforms. "No one is likely to only download and use one platform," he added.

Yong Yang believes that this is, to some extent, due to the "Thousand Yuan Shop" business that AliExpress has been promoting. The prices of the products are basically in the range of a few thousand Korean won, but AliExpress is also launching more new projects. For example, AliExpress is re-launching the women's fashion category, with an average order value of 10,000-30,000 Korean won, "with a focus on bringing high-quality Chinese-made products to Korea." In addition, the recently launched K-venue channel by AliExpress is also adding some unique local supplies from Korea.

02

Consumers Who "Have to" Shop Cross-Border:

Low prices are not the only important factorIn 2023, AliExpress did not disclose the overall data for the overseas Double 11 and Black Friday period. However, in a recent media communication meeting in South Korea, the relevant person in charge disclosed several data during the Double 11 period in Korea: the year-on-year growth of female consumers increased by 386%; in November, the sales of large products such as household appliances and furniture increased by 213% and 475% year-on-year respectively.

Taking large-item merchants as an example, the products sold on AliExpress are much cheaper than similar products in the local market. For example, a 100L small refrigerator, which starts at $1000 on Hi-mart (the Korean version of Suning), only costs 1000 RMB on AliExpress. If choosing an unbranded product, it could even cost only six or seven hundred RMB.

Zhao Haicheng pointed out that the correct way to do cross-border business in Korea should be to choose small-sized products with a unit price between 10,000-40,000 won. Most of the products handled by his overseas warehouse are pants, dresses, gloves, scarves, plush toys, swimsuits, celebrity merchandise, and cat scratchers. "These products have considerable demand in the Korean market. The products in this price range are also the most suitable for selling. If the unit price is too high, there will be greater pressure to stockpile."

The popularity of these categories is related to Korea's long-term single culture. Mukbang (eating show), makeup bloggers, are some of the most popular channels on the Korean internet. The "online celebrity effect" often brings about tremendous consumer power—during a segment of Mukbang featuring Korean girl group MAMAMOO member Hwasa, there was a time when the supply of Korean beef intestines was temporarily exhausted.

The developed internet business formats and refined lifestyle pursuits correspond to relatively limited local supply. Even though there are many local e-commerce platforms, they all face a common problem: they focus more on certain niche categories and IPs, and the variety of goods is far from sufficient. Many consumers have to choose more shopping channels.

According to South Korean customs data, the cross-border e-commerce purchases in South Korea from the first quarter to the third quarter of 2023 amounted to 4.79 trillion won (approximately 26.6 billion RMB), a year-on-year increase of 20.4%. From the perspective of trading partners, the scale of purchasing Chinese goods through cross-border e-commerce was 2.2217 trillion won, accounting for half of South Korean users’ total cross-border purchases.

As AliExpress and Temu enter the Korean market, Pinduoduo also offers cross-border shipping specifically for goods sent from China to overseas. This service is often used by Chinese students studying in Korea and local Korean consumers, despite occasional incidents of lost or missing parcels.

According to Zhao Haicheng, the main source of goods on mainstream local e-commerce platforms in Korea also comes from China. Similar to 1688 in Korea, the goods are mostly purchased in large quantities from suppliers in China for retail in Korea. He recalled that a few years ago, some scarce goods, such as small electronic products and daily necessities, could be sold at a markup of 3-5 times.

"More than half of the clothing in Dongdaemun in Korea comes directly from China," Yongyang said. Dongdaemun was once a popular tourist destination in Korea. Chinese visitors who shopped here would often see "Made in China" labels, and it was a common joke that goods meant for export were being sold domestically.

"More mature Korean sellers will directly purchase from 1688 or go to Yiwu for purchases. There are also companies specializing in purchasing that set up offices in Weihai and Yiwu just for Korean companies, providing services such as purchase, evaluation, inspection, and transportation," Zhao Haicheng said.

Despite this, due to cultural and language barriers, many local e-commerce platforms in Korea find it difficult to truly delve into the Chinese industrial sector, and they still face the problem of insufficient variety of goods in their mall.

This is also considered by Yongyang as the biggest advantage of AliExpress and other Chinese e-commerce platforms compared to local Korean e-commerce—e-commerce platforms from China can organize hundreds of millions of products and carry out distribution. "The competition between Chinese supply and local supply is, in my opinion, the most critical point—what we can buy here, cannot be bought on other platforms. This is a very important differentiating competitive advantage," he said.

"Consumers' decision logic for purchasing is: are there abundant goods? Are there good prices? Is there a faster logistics experience? Is the payment secure enough?" Yongyang mentioned that AliExpress's success in Korea is mainly attributed to extremely low prices, which is the most explicit factor, but the core factor is user experience.

In the mainstream perception of Korean consumers, there is a noticeable difference in delivery time between cross-border e-commerce and local e-commerce platforms: local e-commerce platforms generally offer next-day delivery or even same-day delivery, while the delivery time for cross-border e-commerce is usually around one to ten days, and occasionally there would be incidents of several months. Therefore, the launch of the "Five-Day Delivery" is an important move for AliExpress in the Korean market.

AliExpress has also launched free shipping and free local return services in Korea. This service allows consumers, under certain conditions (usually within 15 days), to return the goods for reasons unrelated to product quality, and the returned items will be sent directly back to a local address.

Temu's strategy in Korea is no different from other markets. In addition to steep discounts, it also provides a 90-day free return service.

According to Zhao Haicheng, the one-way return cost of goods for local e-commerce platforms in Korea is approximately 3000 won (about 16 RMB), and if a personal pickup is requested, the cost will increase to 4500-5000 won (about 24-27 RMB). If consumers simply do not want the product, they need to bear the return cost themselves—clearly a significant expense.

As a result, the free return service of the two Chinese e-commerce platforms has gained popularity. No consumer would refuse free shipping and freight insurance, even special videos teaching people how to take advantage of this have appeared on YouTube.

As for the goods that are returned, Ebrun has learned that AliExpress will soon launch a service to return goods to designated addresses in mainland China, and sellers can also choose local pickup or abandon ownership of the goods. For local sellers on Korean e-commerce platforms, many will entrust local overseas warehouses in Korea, where the goods are inspected for damage and, if they do not affect secondary sales, they are stored there. If orders arise, they will be shipped from the overseas warehouse.

Of course, faced with the fierce competition from AliExpress and Temu, local e-commerce platforms in Korea are not without a response, and many platforms have begun to increase their investment in cross-border goods.

However, most of the competition is limited to platforms, and it does not have a significant impact on sellers. Several individuals told Ebrun that the aggressive expansion of AliExpress and Temu would inevitably take away some of the traffic from local e-commerce platforms. However, Coupang seller Zhai Guoliang pointed out that many sellers in the Korean market choose to position themselves on multiple platforms, including independent sites, live streaming, etc., and the comprehensive income is relatively stable.

Efficiency is deeply rooted in genes

Logistics speed becomes a crucial mental factor

"Efficiency" and "speed" are deeply ingrained in the genes of the Korean people.

"The consumption concept of the Korean people is very 'urgent'. When faced with a $20 item delivered the day after tomorrow or a $25 item delivered tomorrow, basically everyone will choose the latter," Zhao Haicheng said.

Coupang's core advantage in Korea lies in the Rocket Delivery, which provides next-day delivery in most categories and, in some cases, even same-day delivery. A Coupang merchant presentation obtained by Ebrun showed that Coupang has 15,000 drivers in Korea, over a hundred warehouses, with 70% of Korean residential areas within a 7-kilometer distance.

In the two modes of local store and cross-border store that Coupang opens to Chinese sellers, due to policy limitations, cross-border stores must enter the Korean market through cross-border direct mail—this is also the main circulation form for AliExpress in Korea. Only local stores can stock up in overseas warehouses and enjoy the tilt of traffic and next-day delivery.

According to a Coupang merchant who spoke to Ebrun, the delivery time for the front-end shopping page directly indicates the logistics delivery efficiency. Under otherwise equal conditions, the next-day delivery from local stores is obviously superior to the seven-day delivery from cross-border direct mail.

However, operating local stores in Korea is not easy: the most basic requirement is the registration certificate of a local Korean company, which takes at least three months to obtain, and a local business entity in Korea is a necessary condition; after the store application is approved, products in categories such as mother and baby need to go through Korean KC certification, which is also a significant expense.

This is also the frustration for many cross-border sellers targeting the Korean market: a relentless inflow of goods, products that do not conform to certification, and goods being rejected are not able to be returned due to high shipping costs and cumbersome processes, resulting in the loss of investment.

The above-mentioned merchant told Ebrun that because of this, in some gray areas, the price of a local store can be sold for tens of thousands of won, while a cross-border store is worth only a few hundred yuan.

The enormous advantage of local stores has led to a surge of Korean overseas warehouses. For example, the overseas warehouse operated by Zhao Haicheng in Korea is countless, and most of them are used by cross-border merchants that operate local stores for various channels such as Coupang, Naver Shopping, providing one-piece fulfillment, and even assisting in obtaining a Korean business license. Some small and medium-sized local Korean sellers do not even need to prepare a warehouse and can simply stock up in a room at home.In the capital area of South Korea, next-day delivery has become a common consensus for online shopping, but consumers have much looser expectations for cross-border e-commerce compared to local e-commerce platforms, with a general psychological expectation of around 10 days. Despite the fact that AliExpress and Coupang have set up overseas warehouses in Weihai, just a few hours away by cargo ship from Korea, Zhao Haicheng stated that a large amount of time is spent on customs clearance for goods entering Korea from China, usually taking about 5 days, unless the platform has corresponding customs clearance channels for quick clearance.

However, the faster, the better it meets the preferences of Korean consumers.

Yong Yang stated that after achieving five-day delivery, AliExpress's three-day and next-day delivery services are also steadily advancing. "We are considering building warehouses locally to provide a better service experience for consumers." He mentioned that AliExpress is currently exploring the possibility of establishing local warehouses with local partners in Korea, and part of the return capabilities will be handled by local warehouses.

Yong Yang also revealed to Ebrun that AliExpress is building logistics capabilities and developing new logistics routes from Weihai to Korea to accommodate the transportation of oversized goods weighing over 30 kilograms. "We believe this is the next opportunity in terms of product categories." Currently, this project is in the internal testing phase and is expected to be officially launched after the Spring Festival.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com