Valued at 4 trillion! Guess who will be the "sexiest" three big players in 2024?

By Wang Yu

Edited by He Yang

【Ebrun Original】In 2023, it was once positioned as a "slow recovery" year: growth, but with resistance; moving forward, but resisting headwinds.

If someone were to ask who the "pioneer" of the cross-border e-commerce race in 2023 was, I believe that most practitioners would unanimously point to the "fully hosted" model. This may not be a novelty, but it is still an amazing paradigm shift.

Since Pinduoduo's cross-border platform Temu fired the first shot in September 2022, the "fully hosted" trend has swept the world with an unbeatable momentum, allowing overseas consumers to experience an unprecedented "cost-effective shock". From the initial monthly GMV of only $2 million for "unknowns" when it landed in the United States, to the "tough dark horse" expected to achieve a target annual GMV of $14 billion, Temu, which has taken up the flag of full hosting, is creating history and igniting a new round of "chasing war".

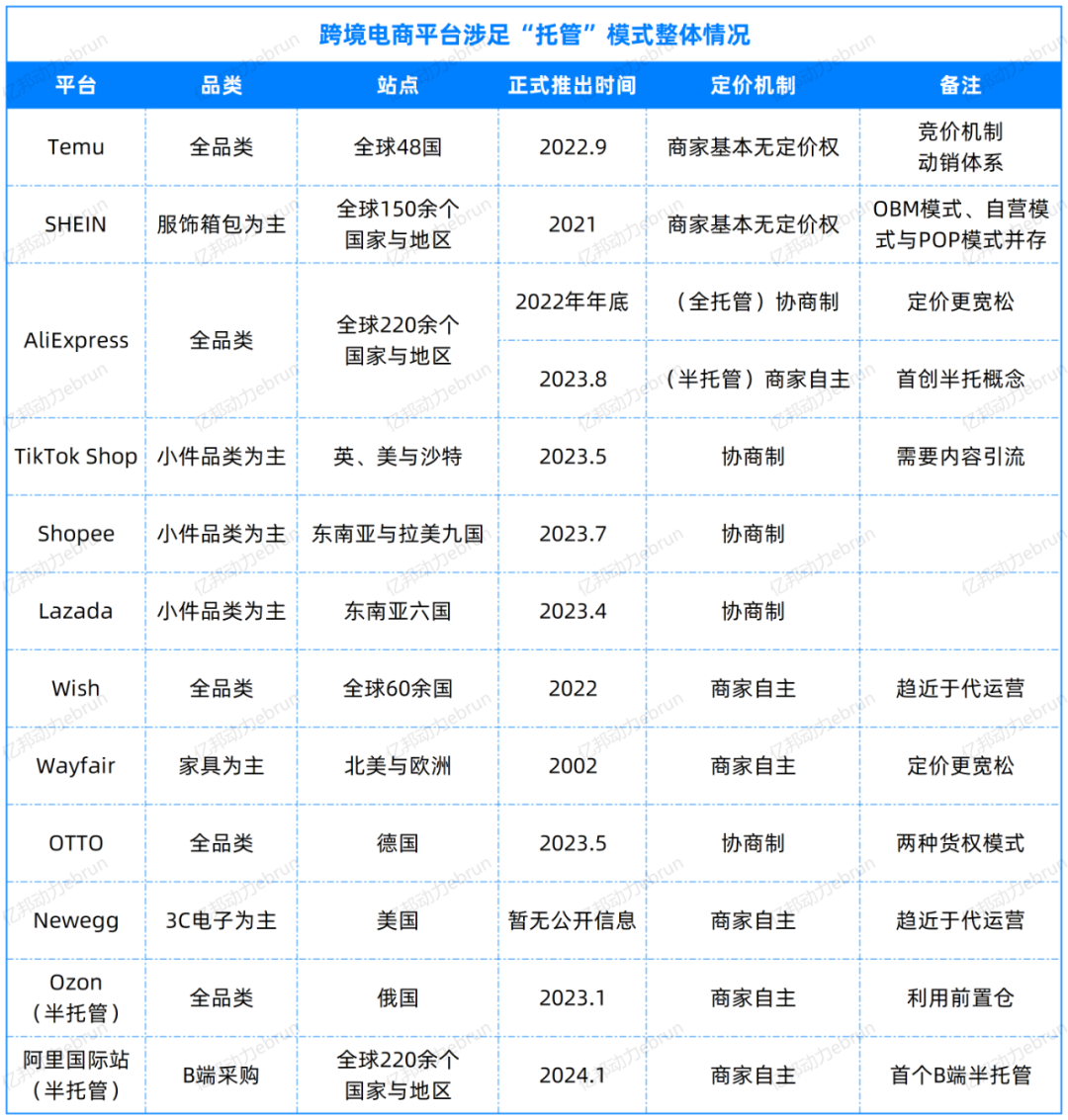

Behind it, a host of platforms have also risen to the challenge and bet on full hosting. In addition to TikTok, SHEIN, and AliExpress, which are known as the "four little dragons" of cross-border platforms, many regional cross-border e-commerce platforms have also joined the surging tide of "fully hosted", attempting to catch up on this express train of growth in the post-epidemic era.

It can be seen that the popularity of the fully hosted model is not only changing the competitive landscape between platforms, but also reshaping people's imagination of the future of the cross-border race: when the overheated consumer upgrade myth begins to cool down, the silent sinking market can also tell a sexy business story.

Reviewing 2023, Ebrun Power has compiled this most comprehensive inventory of "fully hosted" platforms in history, outlining the panoramic view of the rising tide.

01

Market Overview:

Focus on cost-effectiveness and supply chain,

cross-border race in the "fully hosted" mode

Turning the clock back to early 2023, the sudden emergence of a large number of ultra-high-cost-effective products on the market has left many stocking-style POP sellers severely affected from the beginning of the year.

"We were caught off guard. It was originally thought be caused by same-industry price-cutting or malicious price depression, but after investigation, it was found that the reality was completely different," recalled a seller. "These products all came from Temu. The ultra-low pricing, plus platform coupon subsidies, has made the selling price of many products even lower than the cost we purchased on 1688."

The harsh reality made them realize that a strong opponent had quietly risen outside their field of vision. Full host platforms represented by Temu are using the extremely cost-effective edge to launch an offensive against trade-oriented sellers, quickly eroding their market share in the low-value product field.

For a time, the issue of fully hosted has become the focus of hot discussion in the business community of major platforms. In the eyes of early observers, the emergent fully hosted model is like a black hole, full of unknown risks, but also an extremely attractive "chaotic body".

In essence, it is not a novelty.

"Focusing on product supply, the platform manages everything at the front end" does not count as a model innovation, but rather a rehash of old ideas. From Amazon's VC account (Vendor Central, supplier system), licensed brands, and FBA (Fulfillment by Amazon), to JD.com's FBP, LBP, and SOPL platforms and different cooperation models with merchants, these have proven to be mature solutions several years ago. However, now they are rebranded as "fully hosted" and "semi-hosted" models.

What's more, the new generation of players can suddenly burst into a huge voice, not only because of lower entry barriers, more "layman-style" operating rules, and more sinking investment actions, but also perhaps due to the closer relationship with the so-called "timing and place": the general cooling of the international consumer market, and the undeniable idle production capacity of the domestic industrial belt. Both factors have placed "fully hosted" in the temple of the cross-border race in 2023.

The "four little dragons" of cross-border platforms, with similar industrial genes, are undoubtedly the main drivers of this "god-making" process: in September 2022, Temu entered the U.S. market; at the end of 2022, AliExpress began piloting fully hosted, and officially opened in April 2023; TikTok also launched its own fully hosted model in May 2023; and SHEIN, known for its "flexible supply chain," also provides merchants with a "fully hosted" choice.

This was followed by a series of regional e-commerce leaders and other secondary platforms' entry into the market, such as Lazada and Shopee in Southeast Asia, OTTO in Germany, and the once "king of cost-effectiveness" WISH. The list of fully hosted players is not the only expanding element, but also secondary modes such as "semi-hosted" and "customized hosting" that are benefiting from the market windfall brought by the fully hosted trend.

All these players flooding in have made the fully hosted race track not only increasingly crowded, but also escalated the intensity of the competition both on and off the stage.

On one hand, in 2023, major platforms dispatched business teams to enter various industrial belts, tracing back to the production side, competing for the stock of high-quality supply chains. On the other hand, the massive flow buying directly changed the marketing market in the United States and brought a wave of "fully hosted prosperity" to the digital advertising industry.

On the consumer side, fully hosted platforms from China have also sparked a new wave of shopping frenzy. From the viral "haggling" requests on social media, to the surge in app downloads worldwide, the popularity of the fully hosted model is reshaping the shopping minds and habits of overseas consumers.

Data from Google Trends shows that the search volume of "Temu" has increased by 2850% compared to last year, topping the list of annual hot words in the UK. This gives a glimpse that emergent forces represented by Temu are deeply integrating into the daily lives of residents in developed countries.

However, despite Temu being the "flagship leader" that has caused the surge of fully hosted, looking into it further, the full hosting strategies of major platforms are not 100% the same. Based on different resource endowments, merchant ecosystems, and competitive strategies, this "shortcut to seizing incremental gains" has also spawned many different "sub-lines" with their own advantages, leading to a diverse development situation.

02

"Four Little Dragons":

Source of Fully Hosted Strategies,

walking on different development paths

丨TEMU: Thorough and Strong Hosting

Temu has inherited the consistent style of its parent company Pinduoduo, and is skillful in all aspects of market competition, marketing strategies, and industrial development, hitting the heart.

In less than 5 months, Temu spent 14 million US dollars to appear in the Super Bowl, directly shouting the slogan "shopping like a millionaire" in front of 208 million American audiences. After one year of establishment, its number of American users surpassed 100 million, with a daily GMV reaching as high as 80 million US dollars.

According to Similarweb data, by the end of 2023, Temu’s monthly independent visitors had surpassed SHEIN, and was at par with the long-established veteran AliExpress which has been in operation for 14 years, becoming the second only to Amazon and the "covetor of the throne."

Apart from the dazzling marketing actions and the billions of dollars burned for this purpose, the fundamental support for Temu's "leapfrog acceleration" is its carefully designed efficient supply mechanism: the platform firmly grasps the pricing power, replacing the bargaining negotiation model with buyers’ accounting to accurately align costs with 1688, or even lower. Moreover, there are two mechanisms—the "dynamic sales system" and the "bidding management"—to ensure price competitiveness and perpetual product popularity.

The former, through monitoring the sales data, imposes penalties on merchants with high prices and low sales by reducing prices or terminating supplies. The latter follows the principle of "the lower the price, the higher the chance," and promotes the slogan "successful bidding, one in a hundred, exclusive traffic for the same product," encouraging sellers to engage in "price competition" until the most competitive players who are closest to the "profit floor" stand out.

It can be said that despite various controversies, Temu's supply chain system undoubtedly achieves the maximization of "cost-effectiveness," and also establishes a fundamental framework and strategy for all latecomers.

丨SHEIN: Parallel Operation of Platform Operation, Platform Consignment, and Merchant Self-operation

Different from the soaring Temu, SHEIN prefers a more stable expansion strategy. As a giant that started from the fast fashion category, SHEIN has been deeply cultivating and constructing a more segmented and supplier-capability-focused supply chain system in the self-operated mode based on the characteristics of the garment industry over the past decade.

"The logic of Temu is to see goods, while the logic of SHEIN's self-operated mode is to see factories; the former targets the cost-effectiveness, while the latter prefers those capable and compatible merchants," said a merchant.

In addition, the self-operated mode that SHEIN relies on is to cooperate with suppliers in the form of order purchase, with the ownership of goods rights belonging to the platform, relieving the pressure on the merchant side. According to the differences in the production capabilities of merchants, this mode is further divided into three different forms:

OEM, where the platform provides the style, and the supplier produces according to the picture; FOB, where the platform provides samples, and the supplier provides labor and materials for production; ODM, where the supplier provides the style, the platform’s buyers select the style, and the supplier then proceeds with production.

In addition to the traditional self-operated mode, SHEIN has also launched an OBM agency sales mode similar to "fully managed" operations. Unlike the self-operated mode, which focuses more on long-term cooperation and nurturing the comprehensive capabilities of garment factories, the OBM mode shifts its focus to spot pushing and non-apparel categories. The ownership of the goods right has also been transformed from order purchase to sales settlement.

In addition, since May 2023, SHEIN's open platform business and the recruitment of POP merchants have also been proceeding vigorously, becoming another parallel mode aside from its self-operated business and agency operations—matching suppliers of different types and capabilities.

丨AliExpress: From "Managing a Lot" to "Managing Less"

As the oldest platform among the "Four Little Dragons," AliExpress urgently needs to find new development strategies under the pressure brought by various emerging forces, and tell more imaginative stories to boost morale. The fully managed mode undoubtedly provides it with an excellent transition grip.

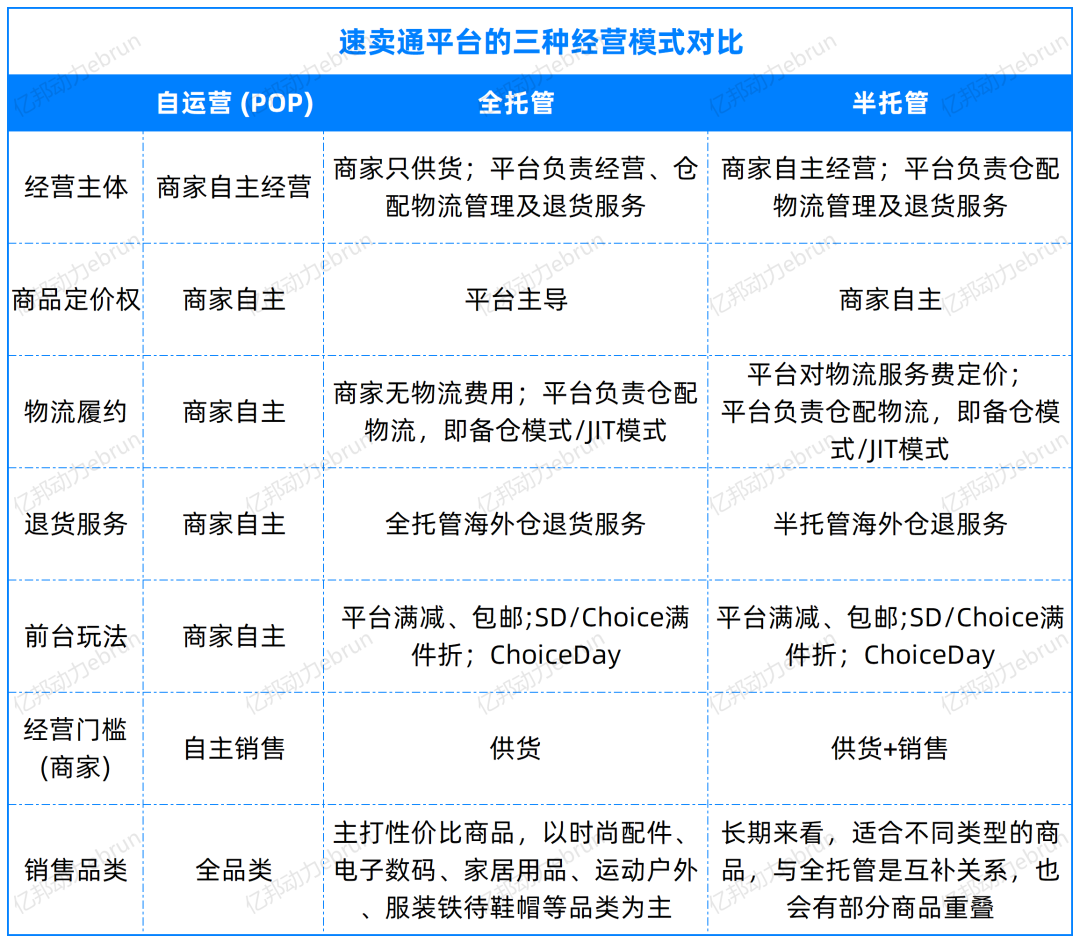

Mechanically speaking, AliExpress' fully managed mode is highly similar to Temu, both adopting the basic framework of "merchants are responsible for supplying, and the platform is responsible for logistics, operation, and after-sales." However, according to multiple merchants, in terms of the core issue of pricing, compared to the more strict core pricing of Temu, the cooperation between AliExpress and merchants is more "negotiable," providing greater freedom in pricing.

The semi-managed mode is another strategy that sets AliExpress apart from other platforms. The so-called semi-managed model is essentially where the platform completely relinquishes its pricing and daily operations, only providing solutions such as logistics warehousing, exclusive marketing activities, and reverse returns for merchants. In contrast to the "comprehensive" fully managed mode, the "managed" nature of the semi-managed mode is greatly weakened, and is more focused on fulfillment services similar to Amazon FBA.

Some merchants pointed out that the birth of the semi-managed mode is like a compromise option between the fully managed mode and merchant self-operation (i.e., open platform business). While providing official logistics services to third-party merchants, the semi-managed mode also opens the traffic entrance enjoyed by the fully managed business—Choice channel.

Moreover, it is speculated that with the goal of focusing on the US market in 2024, AliExpress will further promote the semi-managed business for POP merchants to improve the consumer experience, and thus secure its market share in the increasingly fierce stock competition.

丨TikTok Shop: Content Production is Key

TikTok is perhaps the most unique among the "Four Little Dragons." Its social attribute is not only a valuable gift to e-commerce business but also to a certain extent, a barrier to entry. Different from traditional shelf-based e-commerce platforms, the fully managed business of TikTok Shop, like merchant self-operation, cannot directly obtain effective organic traffic and convert it into orders. It requires proper content production to intercept traffic.

"The fully managed business of the platform is currently cautiously promoted in the TikTok app and has a secondary entrance. Consumers need to enter the mall first and then find it from the bottom bar. Merchants should provide video materials to promote the products in order to obtain more traffic," said a seller, indicating that the fully managed business of TikTok Shop cannot be entirely "hands-off" or cross the operational gap, and also requires content production and considering cooperation with influencers.

Currently, the fully managed business of TikTok Shop is only cautiously advancing in three sites: the UK, the US, and Saudi Arabia. In addition, contrary to platforms where factory-type merchants are the main actors, those participating in the TikTok Shop fully managed mode are more of trade-oriented sellers—they have stronger marketing and content capabilities.

For this platform driven by short videos and live content, how to better place this new business of fully managed in order to better stimulate its growth potential and whether the massive natural traffic can be effectively converted into "effective traffic" are the key factors that determine the outcome of this game and also what merchants are eagerly anticipating.

03

"Second-tier" Players of Managed Models:

Surprising Strategy? Following Suit? Or Playing Tricks?

丨Regional "Powerhouses" are Catching Up

If the entry of the "Four Little Dragons" has caused strong ripples around the world in the fully-managed mode, the entry of major regional platforms can be seen as the aftermath and repercussions of this influence infiltrating local markets.

In Southeast Asia, two major local giants Lazada and Shopee officially launched the fully-managed model in April and July 2023 respectively, which is basically a reproduction of the mature solutions. It is highly similar to Temu/Alibaba in terms of pricing, goods, logistics fulfillment, and operations, and also provides benefits to sellers such as exclusive activity spaces and product labels.

However, since its launch, the two major platforms have rarely disclosed the recent development of their fully-managed models at the official level, and related data has also rarely been leaked.

Some Southeast Asian sellers pointed out that the dominance of the fully-managed model in the European and American markets does not mean that it can quickly establish itself in Southeast Asia. "First, low-price selling is prevalent in Southeast Asia, and the cost-effective tactics that the fully-managed model highly relies on cannot be performed here; secondly, these platforms have always been dominated by third-party models, and the important priority of fully-managed seems not to be given high importance," the seller stated.

In fact, even Temu, as a leader in the fully-managed model, has shown unsatisfactory results in the Southeast Asian market: After several months of operation in the Philippines, Malaysia, and Singapore, it has not been able to replicate the "miracle" of rapid top ranking in developed countries' markets, and in terms of traffic volume, it has temporarily not caught up with those local platforms.

This raises the question: perhaps the fully managed model is more suitable for developed regions with greater separation from mainstream platforms?

Founded in 1949, the German veteran retailer Otto Group was the first to "eat the crab" among the European local forces.

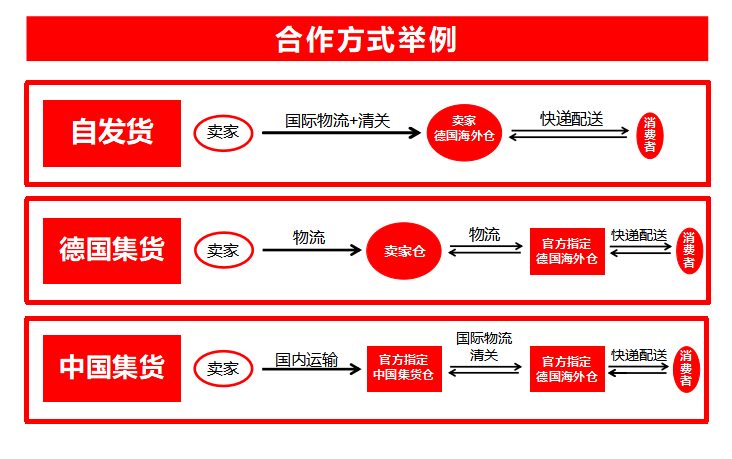

As one of the largest local e-commerce platforms in Germany, OTTO has long maintained strict merchant qualification standards, and only a few third-party sellers with comprehensive strength are invited to settle in each year. In May 2023, OTTO jointly launched the fully-managed business with ECSTORM. The entry requirements for this model are similarly high--sellers must fully comply with German and EU laws and regulations, and must be in strategic categories of OTTO (furniture/home appliances/original clothing and accessories/multimedia, etc).

For product shelving, daily operations, marketing, visual design, and after-sales customer service, the OTTO fully-managed team provides professional service to sellers. In terms of logistics and rights to goods, OTTO is also relatively more flexible compared to other mainstream platforms: sellers have multiple options for domestic and cross-border logistics (as shown in the figure); and in terms of sales, for high-quality sellers who have been approved after evaluation, there are two sales modes to choose from: "sales-based settlement" and "platform purchase".

Currently, OTTO's full-managed model still focuses on the key attribute of "cost-effectiveness". However, in terms of pricing, sellers have greater autonomy; in the negotiation of pricing, the seller's suggested pricing takes precedence.

Faced with German consumers known for their pragmatic approach, can the fully-managed model create a different spark? OTTO's practice may provide a vivid demonstration for this.

丨Old Players "Seize the Opportunity"

The dividends of fully-managed have not only benefited new platforms such as Temu and TikTok Shop, but also brought new development opportunities for many old players.

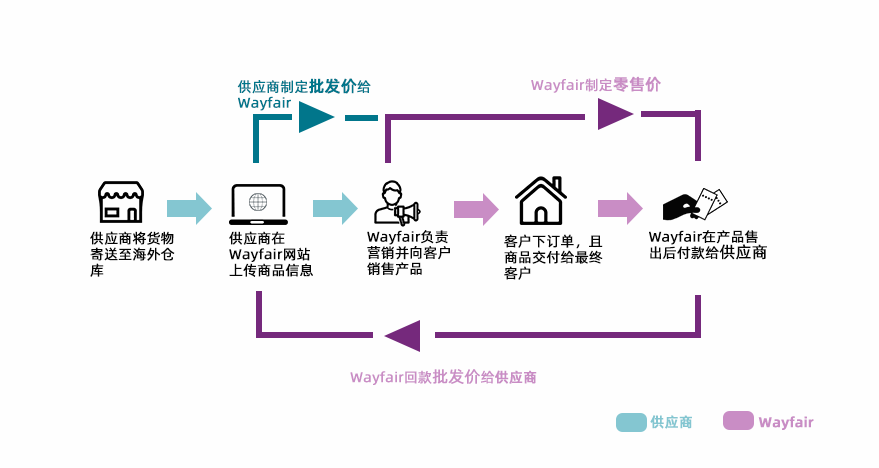

Wayfair, founded in 2002, is a top player in the American furniture e-commerce field, and is the first cross-border e-commerce platform to adopt a "quasi-fully-managed" model. It is not an exaggeration to call it the "originator of fully-managed".

It is reported that since its inception, Wayfair has always adopted a "dropship" light-asset operation model: sellers ship products to overseas warehouses, and Wayfair is responsible for front-end pricing, marketing, and end-to-end delivery, with payments returned to the seller after the product is sold.

However, unlike the fully-managed model of mainstream platforms such as Temu and Alibaba, Wayfair has its unique characteristics in logistics and pricing: in terms of logistics, due to the large nature of furniture items, the platform is only responsible for end-to-end transportation, and domestic and cross-border logistics need to be resolved by the merchants; in terms of pricing, pricing rights are led by the sellers, and the platform will not use pricing pressure through a pricing mechanism, but products with higher cost-effectiveness will receive traffic support.

"Our consistent strategy has always been not to be driven by price as the core driver, but to consider how to provide better services," said Li Zhiming, General Manager of Wayfair Greater China.

Another fully-managed player is Wish, which once held a core position in the sinking market ecosystem. Its Merchant Managed Service (MMS) also provides support in fulfillment, warehousing, operations, pricing, marketing, etc.

MMS is mainly aimed at merchants with offshore needs but lacking cross-border operational experience or experience. Its most notable feature is that it provides end-to-end customized services, which are more close to the "agent operation" model: pricing is completely led by the merchant, and the platform only has the power of suggestion; it can also provide assistance in more complex operational affairs such as image shoots, listing creation, compliance, category release, product hierarchy, data analysis, etc.

However, the profit logic of Wish's managed model is quite different from Temu: the former's profit mainly comes from service fees and sales rake-offs, while the latter's profit mainly comes from the price difference between buying and selling.

In addition, there is also a "brand's overseas management service" from Newegg, a 3C electronics platform listed on the Nasdaq.

Similar to Wish, Newegg's managed service is also customized, targeting companies that already own their brands and manufacturing facilities that are new to transformation with no experience. For the former, future market entry, operations, promotion, logistics, and fulfillment are handed over to the platform; for the latter, the platform provides two cooperation modes:

(1) Brand mode, the factory directly registers the brand overseas, and Newegg helps it to promote overseas as a brand;

(2) Supply mode, the factory is only responsible for production, becoming part of Newegg's own brand supply system.

In either mode, pricing, operational decision-making power, and brand equity all belong to the seller. Sellers can even use the full-chain ecological services provided by Newegg for sales on other channels such as Amazon, eBay, and independent sites.

In the context of Newegg, "managed" is no longer a simple "unified purchase and sale" but more like a platform empowering buyers with insight, packaging and selling operational resources.

丨Renaming Fulfillment Services

In addition to various hosting solutions, the "semi-hosted" model proposed by AliExpress is also being adopted by more platforms. However, for most "semi-hosted" players, their solutions seem more like attaching a new name to fulfillment services.

For example, Russian e-commerce platform Ozon launched the FBP semi-hosted cooperation model in October 2023. Sellers participating in this model only need to ship goods to Ozon's front warehouse in Dongguan, and the final logistics delivery after placing the order is fully handled by the Ozon platform, while the store operations are still the responsibility of the sellers themselves. Essentially, this model is an extension and supplement of platform logistics services.

For merchants, the greater value of the semi-hosted model lies in the relatively higher cost-effectiveness of logistics - achieving the best timeliness at the lowest price. In addition, the platform will provide additional benefits such as free warehouse rental and traffic support to help improve search rankings.

Another platform focusing on the semi-hosted model is Alibaba's international site targeting the B-end procurement market.

Its semi-hosted business is an optimized result based on the RTS service (Rapid Trade Stream) launched five years ago. It focuses on the convenience of logistics fulfillment, providing delivery solutions that meet the needs of B-end sellers, such as cross-shop mixed batch, pick-up and immediate settlement, and multiple timeliness standards, as well as template-free configuration.

For merchants on the Alibaba international site, the semi-hosted model not only means more certain and shorter delivery times, and standardized fulfillment methods, but also exclusive labels and activity channels, providing more exposure opportunities.

It can be said that from mainstream cross-border platforms, to regional domestic e-commerce, and then to B-end platforms, the "fully hosted" model pioneered by Temu has profoundly influenced the overall competitive landscape of the cross-border track, bringing about a collective transformation of integrating resources and improving efficiency.

If 2023 can be defined as the "full hosting year," then with the successive appearance of various players, a new competitive race and contest has emerged on the horizon. The advent of 2024 may bring about an unprecedented full hosting war that brings new shocks to the cross-border track.

[Copyright Notice] Ebrun advocates respecting and protecting intellectual property rights. Without permission, no one is allowed to copy, reproduce, or use the content of this website in any other way. If any copyright issues are found in the articles on this website, please provide copyright questions, identification, proof of copyright, contact information, etc. and send an email to run@ebrun.com. We will communicate and handle it in a timely manner.

Translated by AI. Feedback: run@ebrun.com